by Balustrade Creative | Dec 20, 2019 | Financial Advice

Have you always dreamed of having your own small business? Have you finally started doing what you always wanted to do, but you lost your enthusiasm along the way? It happens. There are struggles with budgeting, time management, client hunting, and competition, you...

by Balustrade Creative | Nov 19, 2019 | Financial Advice

Owning your own business is an entrepreneur’s dream. But with it may come financial stress running your business. You may be stressing wondering if you’ll have enough cash each month to have a long-term, successful business. Improving your cash flowing...

by Balustrade Creative | Nov 1, 2019 | Business Financing, Financial Advice

Getting a business loan can be stressful and difficult. You may be asking yourself: “Where do I start?” “How much do I need?” “How quickly can I get funding?” There are several different factors both traditional banks and alternative lenders use when determining...

by Balustrade Creative | Oct 4, 2019 | Alternative Business Financing, Business Financing, Financial Advice

Small Business Funding has worked with thousands of small businesses seeking funding for their business. We’ve seen and heard it all throughout the years. We know firsthand the challenges small businesses face when seeking financing. Our goal is to fund every...

by Balustrade Creative | Sep 10, 2019 | Alternative Business Financing, Business Financing, Financial Advice

How do you go about finding the perfect lender for your business? When your business needs additional funding to make payroll, purchase new equipment, expansion, ensure cash flow, or any number of reasons – how do you decide who to go with? Do you call your local...

by Balustrade Creative | Aug 30, 2019 | Financial Advice, Insights To Business

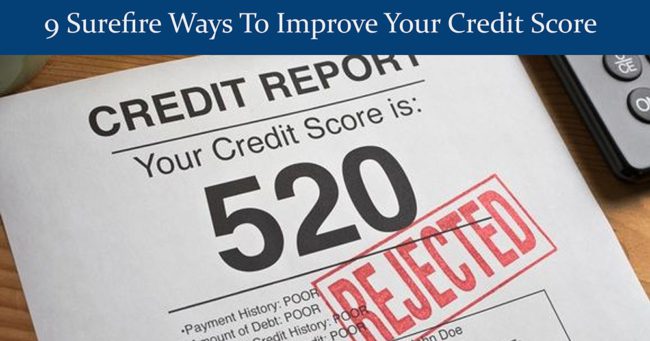

You may be a successful, profitable business owner. Your organization may have an excellent business credit score, pay your creditors on time, and have never had a financial issue with your company. Yet go for a business loan at a traditional bank and they factor in...