What is a working capital loan?

Working Capital Loans are loans that are taken out to finance the day-to-day operations of a business, rather than a financing option that is used to grow a business through acquisition or buy long-term assets. These loans cover short-term operational needs such as payroll, rent, and debt payments.

These types of loans are often used in industries that have cyclical sales or seasonal sales. As such theauy may be cash-rich several months of the year, but cash-lean through the off season.

Working capital loans are often used in these situations to get small business funding to a company through periods of reduced business activity. This is common in retail, but also in the manufacturing companies that supply those retail outlets. These loans are usually taken out during sparse periods and repaid during the busy season.

What’s the difference between a working capital loan and a working capital advance?

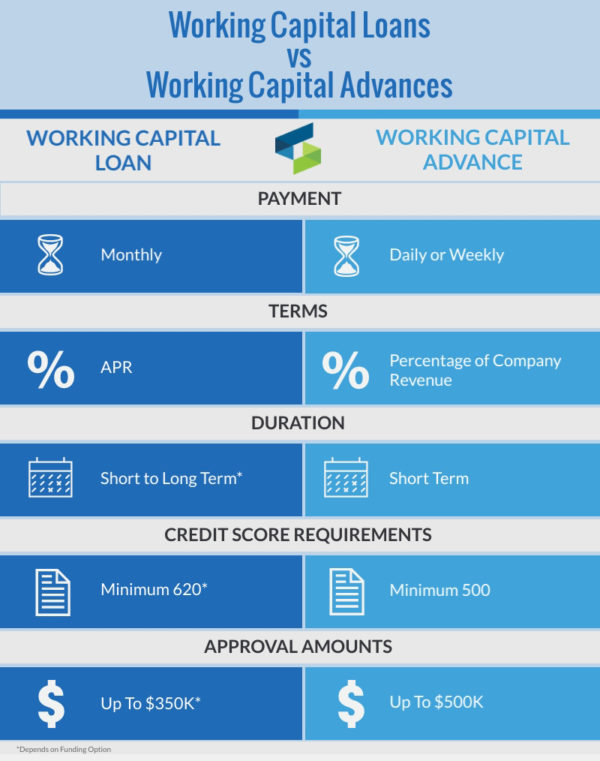

A working capital advance (also known as a Business Cash Advance or Merchant Cash Advance) is not considered a loan. It is an advance of cash on your future credit card receivables. For this reason, there is no APR rate and no set repayment terms. There is only a set payback amount. A flat fee will be charged to you for the advance. In most cases, these short-term working capital advances have a term of between three and twelve months.

Why would you choose a working capital advance?

A working capital advance is ideal for a business owner who has had trouble obtaining funding from a traditional bank due to poor personal credit or lack of time in business. A working capital advance places less importance on these factors. However, they are deemed to be a high-risk advance and because of this the cost of capital will be higher.

A working capital advance can be a great way to finance your holiday inventory, as chances are that you’ll need cash immediately, and working capital advances can get approved quickly. You don’t have to meet with a business manager and assemble all your business documents in triplicate—and you definitely don’t have to wait a month for the bank to get back to you about your approval. Repayments are made either daily or weekly via a business’ merchant processor or via a daily ACH debit from you company bank account.

Working capital advances don’t affect your business credit limit, either. If an emergency happens, you can still turn to your credit cards or bank to find your way out of a struggle. These advances don’t cap your limit.

Why would you want a working capital loan?

A working capital loan can help when a company is in a tight spot and needs funding for short term goals. It costs less than a working capital advance, because better qualifications are required; a higher credit score, longer time in business and superior annual revenue. Such a loan also has more standard repayment plans and offers more flexibility compared to an advance.

Working capital is the difference between your business’s current assets and liabilities. Assets may include accounts receivable, inventory, and cash on hand. Liabilities may include accounts payable and any payments on business debts due in the next 12 months. The SEC defines it this way:

“Working capital is the money leftover if a company paid its current liabilities (that is, its debts due within one-year of the date of the balance sheet) from its current assets.”

So, if you have assets worth $300,000 and liabilities of $150,000, your working capital ratio is 2:1.

Working capital loans can leverage that ratio for your benefit for short term expenses, such as seasonal work, a downturn, or an emergency. These short-term loans aren’t meant to solve all your problems. They are a stopgap to prevent the problem from getting any worse—and then allow you a pathway to working your way out of that debt.

Types of Working Capital Loans

Short-Term Loans

Because working capital is generally used for daily expenses, loans designed to help cover those costs will typically have shorter payback terms. Often these loans are called cash flow loans and must be repaid within one to three years.

They’re generally not meant to pay for investments like real estate or equipment.

Business Line of Credit

Even businesses that aren’t experiencing any cash flow problems may benefit from a working capital line of credit. This borrowing allows you the flexibility to take as much as you need. You can pay it back as you can. And then borrow from that same source in the future without needing to go through the hassle of filling out a new ream of paperwork.

SBA Loans

If you have good credit, you may be able to qualify for a low-rate SBA (Small Business Administration) loan to help you with your working capital. Because the loans are guaranteed by the SBA, they pose less risk to lenders, which makes them appealing and affordable.

The catch with SBA loans is that there are a lot of hoops you have to jump through to get one, and it isn’t easy. In addition to both business and personal credit score requirements, you need to satisfy several other criteria as well. The process may take up to 90 days.

Types of Working Capital Advances

Merchant Cash Advances

A merchant cash advance isn’t a traditional loan, but it is a way for businesses to access the cash they need to make ends meet temporarily. To be eligible for a merchant cash advance, your business needs to accept credit cards, because the lender takes a percentage of all the credit card purchases that are received by your company until the advance is paid off. Also, you need to have a credit score of at least 500, been in business for at least 6 months, and have a monthly revenue of at least $15,000. This is a good source of quick liquidity but can have steep APRs.