How do you go about finding the perfect lender for your business?

When your business needs additional funding to make payroll, purchase new equipment, expansion, ensure cash flow, or any number of reasons – how do you decide who to go with?

Do you call your local bank?

Do an online search?

Then what –

Go with who said YES first

Go with who gave you the best rate and terms (certainly this is important)

But I would implore more should go into your decision making.

Your lender should be more than an organization who loans your business money. You should be more then a number. A good lending company will work with you not just through the initial application and approval process but throughout the life of your loan/funding and beyond.

You should look for a partner that has your best interest in mind. One that will help your business succeed and grow. A lender that will treat you as a partner, not just a transaction.

Here are some elements to look for to find the perfect lending partner:

Offer Multiple Funding Options

There are multiple funding options available for businesses:

Invoice Financing

The requirements and payment terms different for each funding type. The type of funding that best fits your business needs and/or requirements will depend on factors such as:

How quickly you need funding

Your personal FICO score

Your company credit score

Previous payment history

Length of time in business

The funded amount

You’ll want to find a lender that offers multiple funding options. This lender can work with you to determine which option(s) best fits your business needs and what you will even qualify for.

You’re limiting your options by going with a lender that doesn’t offer other funding types. And if you get declined for this loan type, you’ll be spending more of your valuable time researching other lenders in order to find one with a plan that suites your goals.

Offer Flexible Payment Terms

Would you rather go with a lender who will penalize you if you can’t make a payment because revenues are down? They may add late fees or send you to collections.

Or would you rather have a lender who will work with you and adjust your daily or monthly payments based on your revenue?

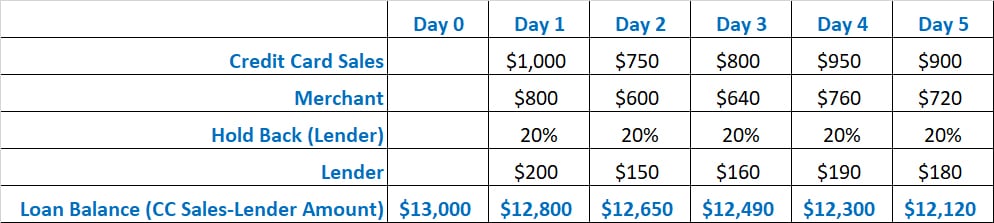

Small Business Funding, for example, has a funding option – Working Capital Advance – where a percentage of your daily credit card receivables are held back for the lender. Your payment is reflective of the daily revenue which generate.

For example, if you are approved for $10,000 in funding with a payback fee of $3,000 and a hold back of 20%, you can see below how your payments are affected by your daily revenue.

Don’t struggle to make your payment because of a few days where you didn’t achieve your projected revenues.

Unrestricted Use Of Funding

Some lenders will require you to submit a business plan which will be reviewed to determine, along with other factors, if you could be eligible for a business loan. Once the application and plan are submitted with how you plan on using the funds, you have no freedom to change how those funds will be used.

You should have the option to spend the loan/funding anyway you desire. As long as it helps the growth and long-term success of your business.

In addition, how you decide to spend the funding should not be a determining factor regarding your loan qualification.

Make The Process Easy For You

There are some lenders which require a lot more paperwork and a longer process. As such, depending on when you need to funding, this could be a factor.

Applying for business funding with a traditional bank will require:

1- you to have a high personal credit score,

2- put collateral up,

3- present a business plan for what you plan on using the loan for,

4- provide financial records, including Business Income Tax returns, Personal Income Tax returns, 12 months business bank statements, 12 months personal bank statements

Applying for business funding with an alternative lender will require:

1- one-page business funding request form

2- most recent 3 months business bank statements

In addition, the timing involved will vary between lenders. The initial process with a tradition bank, for example, can take as much as 60 – 90 days just for an approval.

Alternative lenders can have an answer on your funding status within 24 and, in most cases, you could have funding within 72 hours.

Receive Funding Offers From Multiple Lenders

You have a business to run. You may not have the time to research and contact multiple banks or alternative lenders. The right lending partner will be able to do the leg work for you. Certain alternative lenders, such as Small Business Funding, work with a network of financial partners and will work on your behalf.

Lenders with these types of relationships will be able to get your business access to multiple funding offers from multiple lenders.

Time is money, so save yourself both and let someone else do the work for you.

Provides Financial, Business, and Marketing Advice

Some lenders will approve your business for a loan or funding and once you’ve paid it off, the only communication you will receive from them are solicitations to borrow more. And that’s fine when you need more funding.

Other lenders will seek out more of a relationship with their clients. In addition to approving you for funding, they want to see your business succeed in the short and long term.

These lenders will provide you financial, business, and marketing advice before, during, and after your lending period. If you’re a small business with limited staff and resources, this information can be extremely valuable.

Even if you’re a larger, fully staffed organization, the tips provided may be able to provide advice to help you become more efficient, save money, or increase your customer base.

What Next…

The good news for you – you have plenty of options.

There will be some lenders who genially have your best interest in mind. Others, it’s just a business transaction. There’s nothing wrong with either. It really depends on your preference.

Ultimately you need to decide what’s best for your business.