Have you always dreamed of having your own small business? Have you finally started doing what you always wanted to do, but you lost your enthusiasm along the way? It happens. There are struggles with budgeting, time management, client hunting, and competition, you can easily fall under the pressure. Don’t go there!

Before you start thinking about how hard it is to maintain your small business, try to get an optimistic perspective: there’s always space for growth.

Here are 8 important pieces of finance advice for small business owners that will help you maintain a successful business.

Create a realistic budget

If you need a large capital to maintain your small business, you should consider downsizing. Instead of focusing your entire energy on the end result, focus on the journey. Evaluate your starting point and create a realistic budget that will work for now. Scale down the pricey plans and make your idea simpler so you can manage it with the finances you currently have.

Yes, there are investors willing to support small businesses, however, you have to prove your business model is manageable before you can attract them. That’s why you have to get realistic with the budgeting. For starters, forget about fancy offices, the most expensive computers, and a new car. Spend in the most minimalistic way so you can maximize the results.

Balance your business goals with your personal goals

We see this often: small business owners often get so consumed by their business goals that they forget all about life in general. They quit all contacts; they don’t see their family that much.; they practically don’t live outside the offices.

You don’t want that to happen. You may call it commitment, but it’s more of an addiction that will quickly lead you to burnout.

Write down your business goals. Plan how you’ll achieve them and how much work you’ll need to get there. Then, write down your personal goals. Those are important, too. Your contacts, hobbies, interests, loved ones…etc those are the things that make you the person you are. You lose them, you lose yourself.

Overestimate the expenses

When you’re creating a budget, don’t make it too tight! Be flexible and plan something extra for each expense you have in mind. That’s a good way to prevent unpleasant surprises that would drag your business to a disaster.

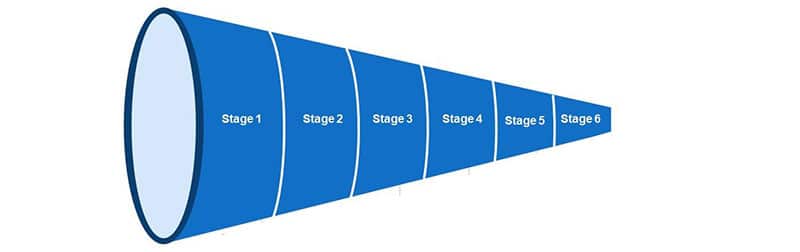

Observe your sales cycle

The sales cycle is not just a marketing theory. It’s a practice that works under most circumstances. It consists of seven stages:

- Identifying new potential customers

- Making an offer

- Confirming the potential of a prospect to buy your product or service

- Presenting an offer they can’t refuse

- Answering the prospect’s questions and addressing their concerns

- Closing the sale

- Attracting recommendations

Observe how all these stages work in the practice of your business. When you understand them, you’ll be able to take your potential customers from one stage to the next one without losing them somewhere in the middle.

Remember: Time is money too

When you manage to reduce the time you and your team spend at work but maintain the results you’re making, we’re talking about productivity.

Do you notice that you and most of your workers are staying overtime? That means the workload is greater, and that’s a good thing. However, it also means your entire team is exhausted, and that’s not a good thing. Consider hiring a few more people, so you’ll maintain the same productivity while giving everyone more time and personal space.

Don’t hire too many people too soon

Remember: you have to maintain a realistic budget. New hires mean new expenses and you absolutely need all the right people in your team, but don’t hire them too soon. Start with a minimal team and add to it when you feel the current workers are getting more workload than they could handle in the ideal circumstances. This means they should be doing enough work to justify their payments, but you mustn’t put them under a strain with deadlines they couldn’t possibly meet.

Find the balance! When you notice that the workload and workforce are outside that balance, it’s time for new hires. More workload means your business is making more money so your budget won’t suffer from the new additions to the team.

Revisit your budget over and over again

Remember how you started your small business with a precise budget? You have your profit and loss budget, but are you tracking the progress and making the needed revisions?

Separate your budget into months for the budget period. Then, evaluate the goals you met and the expenses you made on a monthly basis. See how they fit in the big picture. When you notice that things are not going as planned, you’ll need to revise some aspects of your budget. If you’re struggling with the finances, it’s a good idea to hire an expert to assist you with budgeting.

Ask for discounts!

Do you need desks and chairs for your offices? Are you buying multiple computers at once? Are you hiring an online service to take care of the content marketing campaign? Whatever services or products you need for your business, always find the most cost-effective offer! You need high quality, but you also need to mind your budget.

All businesses are willing to give you discounts when you’re ready to spend money. Don’t be shy and ask for them.

How much potential does your small business have? More than you believe! There’s space for every business idea on the market. Your approach, commitment, and enthusiasm will determine the success of your startup.

Adhering to these 8 Helpful Pieces of Finance Advice For Small Business Owners could scale your business a lot sooner.

AUTHOR BIO

Yassine is a small business owner and co-found of SEO Agency HQ. A firm believer of PLANNING, and loves helping other small businesses thrive. As a digital marketer, Yassine managed to scale his agency to 6-figures and expand to other business ventures. “Focus, Plan, Execute, It’s That Simple” He says.

Yassine is a small business owner and co-found of SEO Agency HQ. A firm believer of PLANNING, and loves helping other small businesses thrive. As a digital marketer, Yassine managed to scale his agency to 6-figures and expand to other business ventures. “Focus, Plan, Execute, It’s That Simple” He says.