Business Loan With Bad Credit Options

Looking for a business loan with bad credit?

You’re not alone. We help thousands of small business owners who have trouble getting funding due to a less than perfect FICO score.

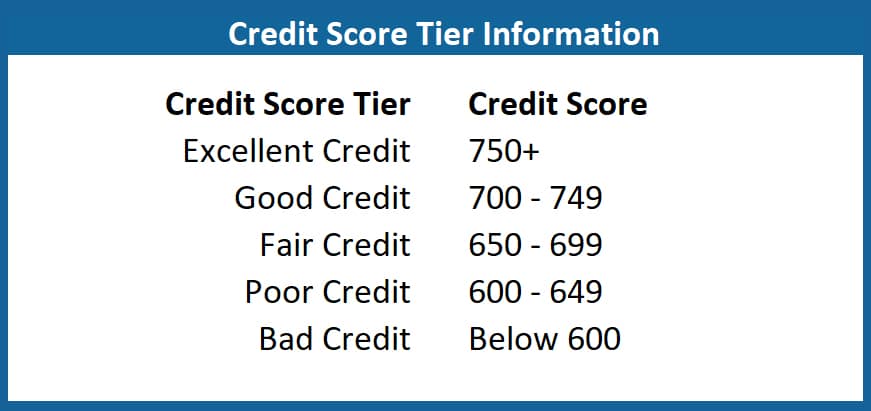

Before alternative lenders, such as Small Business Funding, business owners who had a personal credit score below 649 where declined. Now there are funding solutions you may be eligible for even if your credit score is poor (600 – 649 FICO) or bad (below 600).

Business Loan For Bad Credit Options

There are several funding options available to you with fair, poor, or even bad credit scores. Small Business Funding and our network of lenders take other factors into account to determine if you qualify for funding, such as:

- Monthly revenue, depending on the funding option you will need at least $15k/month in revenue

- Time in business

- Your industry

- The consistency of your revenue (For example, are you always in the positive or are there large ups and downs in your revenue stream)

Here are funding options with bad credit that you may qualify for:

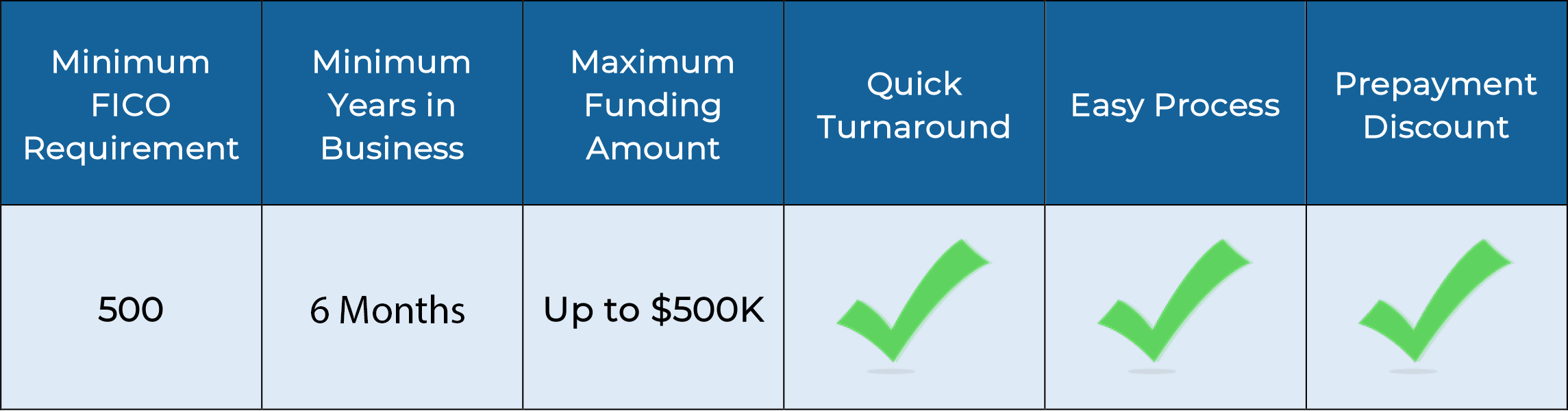

1 – Merchant Cash Advance with Bad Credit

A Merchant Cash Advance (or Working Capital Advance) is your best chance of getting approved for funding with bad credit. This option only requires a minimum credit score of 500.

The approval process for a working capital advance can occur in under 24 hours (in most cases) and you can have funding within two to three days. You will need to be in business at least 6 months and have a monthly revenue of at least $15k to even be considered.

Depending on your monthly revenue and how long you’ve been in business, the approval amount for this option is up to $500,000.

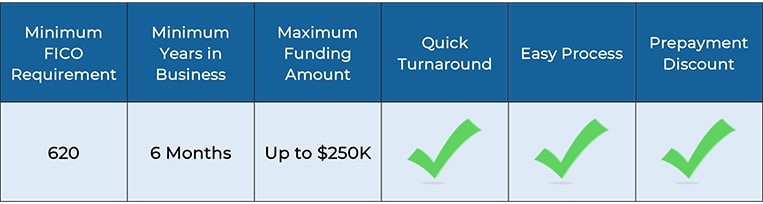

2 – Business Line of Credit for Bad Credit

Getting approved for a business line of credit with bad credit is not as easy as a working capital advance. You don’t need a good credit score but it will need to be at least a 620 to be considered.

The approval process is a little tougher than a working capital advance and the approval process may take a little longer. If you are approved, funding can take place within 24 hours.

In addition to having a FICO of at least 620, some of the other minimum requirements are that you’ve been in business 6 months or more and have annual gross revenue of roughly $300,000.

The approval amounts for this type of funding is between $10,000 – $250,000.

3 – Short Term Loans For Bad Credit

Terms loans for bad credit are similar to a traditional loan. Requirements are a little more stringent then a merchant cash advance or line of credit. To be considered you will at least a 640 credit score, plus you’ll need to be in business at least 2 years.

You will be able to take out anywhere between $20k to $200k.

The timing to receive funding will also take a little longer. If you qualify for a term loan, you can expect to receive funding no sooner than 2 – 4 weeks, maybe even longer.

The repayment terms for a short-term loan may vary between 2 to 5 years. This depends on several factors including the loan amount, time in business, and monthly revenue.

4 – SBA Loan with Bad Credit

An SBA Loan is a loan which is partially guaranteed by the SBA (Small Business Administration). You will need at least a fair FICO (minimum 650), along with at least 2 years in business to be considered.

If approved, the timing to receive your funding will take longer than the other options, at least 4 weeks.

And since this is a government-backed loan, more documents will be required.

The funding for an SBA Loan for bad credit can be between $30k and $350k. And the repayment terms will be paid monthly, up to a 10-year term.

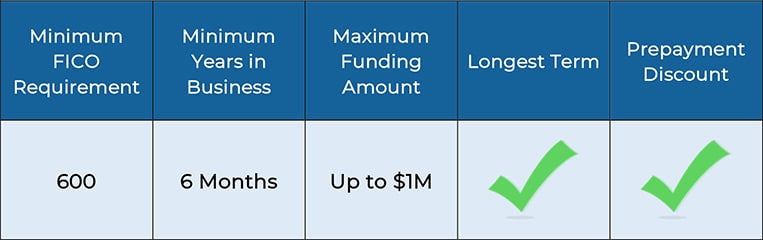

5 – Equipment Financing with Bad Credit

Unlike the other funding options for bad credit, equipment financing will require collateral in the form of the equipment which you are financing.

Since there is collateral backing the loan, the lender does not put as much emphasize on your credit score. A personal credit score of 600 is all you need to potentially qualify.

You may be approved for up to $1 million of the equipment cost.

How To Improve Your Credit Score

The funding option you qualify for may be dictated by your current personal credit score. Here at Small Business Funding we want you to get the most favorable funding terms. Our Funding Managers will review your options to determine if you’re eligible for business funding with bad credit.

They will also discuss ways that you can improve your credit score in order to help you secure more funding options.

Complete our no obligation funding request form today and if you pre-qualify, one of our Funding Managers will be in touch shortly to discuss your poor credit funding options.

Your Bank Say No? Then Lets Talk!