Know What You Owe – Interest vs Rate Factor

These days small and medium-sized businesses have many funding options at their disposal. From traditional term loans and lines of credit, to working capital advances and factoring loans, it’s hard to know how to compare each of these loan products. One surefire way is to compare the overall cost of funds. In order to determine the overall cost and payback you need to look into the interest vs rate factor.

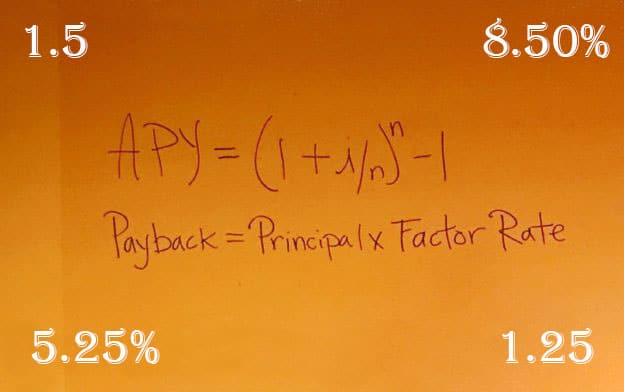

Two of the most common cost metrics used are the Annual Percentage Rate (APR, or interest rate), and the Rate Factor, sometimes called a flat fee, or simple interest.

What is “Factor Rate”?

A factor rate is expressed as a decimal figure and not in percentages the way interest rates are calculated. The decimal figure typically ranges from 1.09 to 1.47. This determines how much you need to pay back on your business loan.

Many business owners are less familiar with a Rate Factor. An easier way to think about this rate is it’s simply a flat fee charged on the funds borrowed.

Factor Rates are more commonly associated with a Business Cash Advance (or Working Capital Advance) where repayments are made daily or weekly via a business’ merchant processor or via a daily ACH debit from your bank account.

What is “Interest Rate”?

Interest Rate is the portion of your business loan that is charged as interest. This is expressed as an annual percentage rate (or APR) of the outstanding loan balance per pay period.

Most folks are familiar with an APR; it’s used for home mortgages, auto loans, credit cards, commercial property and traditional business loans such as a line of credit, SBA Loan, or equipment financing.

How is “Factor Rate” calculated?

Calculating your Factor Rate is relatively simply, just multiply your advanced amount by the factor.

Here is an example:

Advance Amount: $100,000

Rate Factor: 1.25

Term: 12 months

Daily or Weekly Payment Options: $496 Each Business Day, or $2,604 Weekly

Total Repayment: $125,000

Advanced Amount Calculator using a Factor Rate

Enter your advanced amount, factor rate, and monthly terms below to determine your payback and daily (or weekly) payments.

How is “Interest Rate” calculated?

Calculating the interest rate is a little more detailed then the factor rate. Lenders us an amortization schedule to work out your monthly payment and total repayment. so, each month you can determine what that payments interest will be with the following calculation:

Here is an example:

Loan Amount: $100,000

Interest Rate (APR): 5.25%

Loan Term: 10 Years

Monthly Payment: $1,073

Total Repayment: $128,750

Since your interest is recalculated every pay period you can reduce your interest paid by increasing your monthly payments.

Loan Calculator using Interest Rate

Enter your loan amount, interest rate, and years to calculate your monthly payments and total repayment.

How Lenders determine your “Factor Rate”?

The factor you are approved at could be based on several business attributes, including (among others):

- Length of time in business

- Consistency of revenue

- Average monthly revenue

- Seasonality of the business

How Lenders determine your “Interest Rate”?

Here are a few of the determining factors that go into determining your interest rate:

- Type of loan/funding

- Your credit score

- Payment history

Rate Factor Advantages & Disadvantages

Advantages: Quick processing time (1-3 business days); Unsecured; Personal credit not a primary factor; Minimal time in business required (6 months).

Disadvantages: Shorter terms; a higher relative APR (due to unsecured nature); Much more frequent remittances (daily or weekly)

Interest Rate Advantages & Disadvantage

Advantages: Repayment amortized over longer terms (smaller monthly payment); Usually secured, allowing for lower interest rates;

Disadvantages: Typically, a slower process (several weeks to 6+ months); Business owner needs high personal credit score; Longer time in business required (2+ years); Longer loan term leads to higher total repayment.

Which One is Better For Your Business?

The type of funding/loan you take out or qualify for will determine whether your funding is subject to an interest rate or factor rate.

Depending on your credit score, time in business, and annual revenue, you may only be eligible for a Working Capital Advance. In this case your funding is subject to a factor rate.

However, if you are eligible for multiple funding/loan options, determining which is best for your business really depends on your needs. Also how quickly you need funding and how much you’re willing to pay for a business loan/funding.

There can be many other factors and/or metrics to consider as well while searching for the right type of funding for your business. In any case, make sure to properly vet any potential lenders by making sure whomever you choose to work with has prior experience with the following:

- arranging financing for businesses

- knowledgeable regarding the different loan products that might be available given your company’s specific situation

- should be responsive to your requests

You can weigh the advantages and disadvantage interest vs factor rate as outlined above or call one of our Funding Manager’s at Small Business Funding for a personalized consultation.