As a small business owner, you may have a well-run organization which generates a very healthy profit. But to really take your company to that next level of success you need some type of small business funding to invest in equipment, inventory, employees, technology, working capital, and so on.

With a solid business, getting a loan should be a piece of cake, right?

The truth is – it depends.

It depends on several factors, some of which include your personal credit score, industry, time in business, annual revenue. And depending on where you apply for a loan, whether a traditional bank or an alternative lender, there could be many more factors.

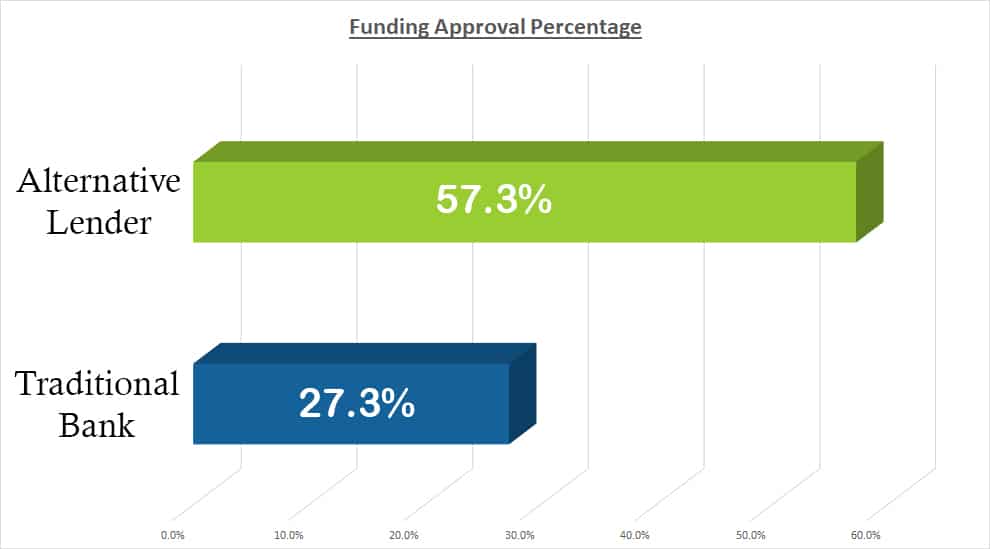

Tradition banks approve only 27.7% of small businesses for a loan. The main reasons are they consider small businesses high risk and their ROI may not be as strong.

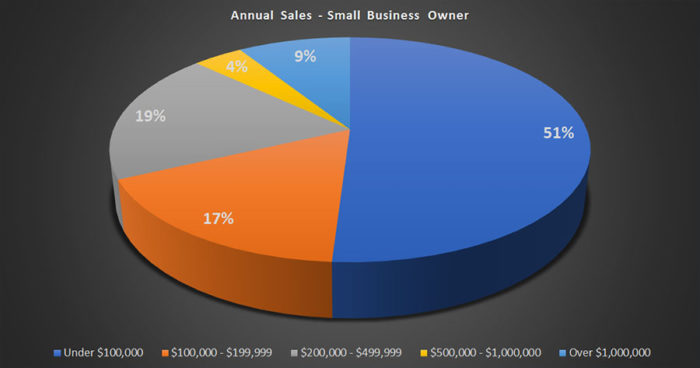

Many lenders have a minimum revenue requirement of at least $100,000. A minimum threshold is needed to ensure the business owner is generating enough money to pay back the loan. According to businessknowhow.com, 51% of small business owners have annual sales of under $100,000. So until your business is on track to generate $100,000 annual revenue, you will most likely be declined for funding.

So whether you realize it or not, as a small business owner looking to grow your business with funding, you may run into several challenges. But there are things you can do today to increase your chances of getting a business loan.

1 – Get your credit score in check

The minimum credit score needed to qualify for a business loan will vary by lender. But on average a bank will require at least a 675 whereas an alternative lender may require a 500. However the lower the credit score, the higher your chances of getting declined.

And if you are approved the loan amount and terms may be less desirable then if you had a good or excellent credit score.

Getting your credit score in check prior to applying for a business loan is essential. There are several ways to improve your credit score, but some methods take longer then others. Here are the three that may have the quickest positive impact on your score. Improving these will increase your chances of getting a business loan.

Check Your Credit Reports

In 2018, only 36% of people obtained and actually viewed their credit report. Not only should you know what your credit score is, but you should also know what’s on your report. Look over your credit reports to see if there are any errors or anything you need to dispute.

Pay Down Any Current Personal Loans

Your credit-to-debt ratio needs to be under 30%, once you exceed that number it starts to negatively impact your FICO score.

To determine your credit-to-debt score you need to divide your total credit limit (the credit available to you from a bank or credit card company) and divide this number by what you still owe.

So before you apply for any business loans, make sure you pay down any credit related bills in order to get your ratio below 30%. This will help improve your credit score.

Remove Late Items With Credit Bureau

If you have any late items on your report, you can ask the creditor to remove them with credit bureau.

However, this will only work if you have a recent history of making on-time payments. The creditor won’t work with you if you have any recent late payments.

Also keep in mind that not every creditor will adhere to your request but it’s worth the phone call.

2 – Don’t get multiple quotes from multiple lenders

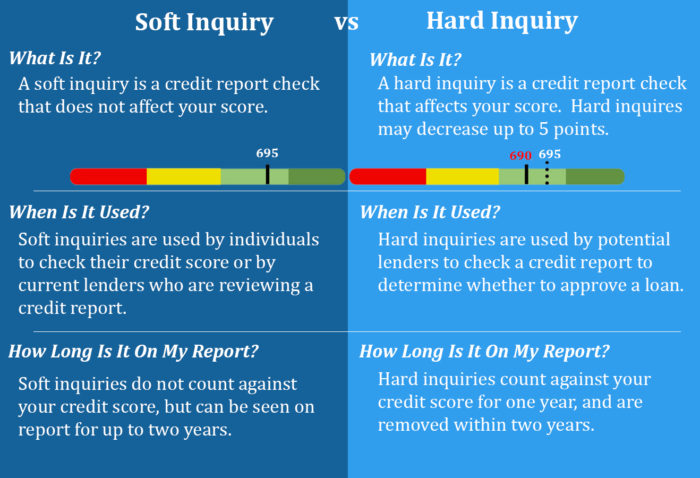

Getting multiple quotes from different lenders sounds like a logical plan. But if you don’t have perfect credit, this may be more damaging to your credit score then it’s worth. The reason being is some lenders will run a hard inquiry of your credit.

A hard inquiry is a credit report check that affects your score. This type of check may negatively impact your score by 5 points with each hard inquiry.

It’s not to say that you can’t get multiple quotes but be careful how you go about this. Before moving forward with a lender, always ask if they plan on a “Soft Inquiry” or “Hard Inquiry” to check your credit score.

Having a hard inquiry check on your report is not bad and may be needed at some point in the funding process. It’s the multiple hard inquiries that are bad. To protect your credit score, it should be run once after you’ve made the decision on which company you plan on taking a loan.

Your best bet would be to reach out to a lender who will work with multiple partners on your behalf.

3 – Reduce negative balance days

Consistent cash flow is a key in getting approved for a business loan. Lenders don’t like to see inconsistency on your balance sheet. This represents a risk.

To a lender, cash flow represents a picture of your companies’ financial ability to pay back a loan. Basically, are you bringing in enough money to cover your current cost obligations, as well as the cost of the new loan.

If you have any negative balance days over the time frame a traditional bank is viewing your business account, you will most likely be declined for a loan.

An alternative lender is a little more forgiving. However, if you are average more than 3 – 5 negative days per month, you will have a more difficult time getting approved for funding.

So before applying for funding, make sure you have a more consistent cash flow.

4 – Choose the right lender

Not all lenders have the same requirements or funding options. And not all lenders have your best interest in mind. So do your homework when deciding which lender will be the best fit for your business.

Compile a list of potential banks and alternative lenders. From there narrow your search by researching what other companies have said about the lender. Most lenders should have a review section on their website. If not, you can see if companies have commented on the Better Business Bureau, TrustPilot, or Google Reviews.

From there, see what funding options each has to offer and the minimum requirements.

Understand what you may qualify for, this will help focus your list on lenders you’ll have a better chance of getting approved. As an example, if you have a credit score of 600, you most likely will not get approved through a bank. So narrow your list down to alternative lenders.

5 – Create a perfectly written business plan

If you decide to get a business loan from a bank then you will need to craft a perfectly written business plan for why you need the loan. Banks want to see that you’ve thought through why you need the money and how this money will help your business grow.

In your plan make sure you have the following components:

Executive Summary

An executive summary is a brief summary of your business. It should highlight what you want to achieve, how you will get there, why the funding is needed, and how it will help.

The executive summary will be the first thing a bank reads, so make sure it grabs their attention and entices them to read through the entire business plan

Company Description

Provide a history of your company and where you plan on being in 3 – 5 years. Explain how your company’s product or service meets the needs of your customer.

Market Analysis

Describe your industry, target market, and competitors.

Organization and Management Structure

Show an organizational chart. Who is the owner and what is their background.

Your service or product offering

Describe your product line or service offering. How it provides a need for your customer. How it’s different from your competition. What are the current and future opportunities and challenges?

Marketing Plan/Sales Strategy

Explain how you currently or plan to market or sell your product and/or service.

Funding Request

List how much funding you need and how it will be used.

Financial Projections

There are 3 main forecasts in this section:

- Cash Flow

- Profits and Loses

- Balance Sheet

6 – Be open to alternative funding options

You stand a greater chance of getting approved for a business loan or other funding option with an alternative lender.

So why would the approval percentage between a bank and alternative lender be so different.

Simple, it has to do with risk.

A bank is not willing to take as great of a risk as an alternative lender. So they set up their requirements to filter out a business they determine to be a higher risk.

Here are a few of the differences between a traditional bank and alternative lender

- Credit Score: Bank = minimum 675 vs Alternative Lender = minimum 500

- Time in Business: Bank = 2 Years vs Alternative Lender = 6 Months

- Collateral: Bank = Yes vs Alternative Lender = No (unless using Equipment Financing option)

- Business Plan: Bank = Yes vs Alternative Lender = No