It costs money to start and run a business, especially as a small business owner. When and how to fund your business may be two of the most important questions you will ever consider. But, if you are eligible, the answer is easy – an SBA Loan. Now the question should now be “How do I get an SBA Loan?”

What is an SBA Loan?

An SBA Loan by definition is a loan which is partially guaranteed by the government. The SBA (or Small Business Administration) guarantees up to 85% of the loan value. That means the lender is guaranteed to get up to 85% the value of the loan should you default on the loan.

The Small Business Administration doesn’t directly lend to small business owners. Instead it backs loans made through lenders, such as Small Business Funding. An SBA guaranteed loan reduces the risk for the lender, making it easier for small business owners to secure funding.

So what does this mean for you?

By having the government offer this guarantee, it minimizes the risk for a lender. It also incentivizes lenders to offer a lower rate to small business owners. Without this guarantee, small business owners would have a more difficult time getting funding from a traditional bank, and in some cases an alternative lender.

Types of SBA Loans

The government offers several different types of SBA Loan programs. The differences are primarily based on how you plan on using the funding and the amount of capital you need.

Although the mechanics of different SBA Loans will vary, the key benefits of each will be to offer some of the lowest interest rates a small business owner will find, plus long-term, monthly payments.

Below we’ve highlighted five of these programs:

SBA 7(a) Loans

This is the most common SBA loan. More businesses are approved for the 7(a) loan then any other SBA loan program. This is a more flexible loan option as it can be used in a variety of ways to help your business.

Requirements: For loan amounts that exceed $350k, the SBA will require a form of collateral

Approval Amounts: up to $5 million

Terms: Repayment up to 10 year, monthly payments.

APR: Several factors go into determining the interest rate for 7a loans such as the base rate, the loan period, and the amount of the loan.

SBA Working Capital Loan

The main difference between the 7(a) and Working Capital Loan is the maximum approval amounts. Since the Working Capital Loan maximum approval is $350k, it does not require any form of collateral.

An SBA Working Capital Loan through Small Business Funding have the following terms and requirements:

Requirements: At least 2 years in business, minimum personal credit score of 650

Approval Amounts: $30k – $350k

Terms: Repayment up to 10 years with monthly payments

APR: 7.50% – 8.50% (Prime Rate + 2.75% to 3.75%)*

*APR as of Feb. 2020

SBA 504 Loan

The SBA 504 Loan is considered an economic development program which promotes growth and job creation within small businesses. It provides funding for the purchase of real estate, equipment, machinery or other fixed assets.

Requirements: must be a for-profit, independently owned and operated; have a tangible net worth of under $15 million and average net income of under $5 million after federal income taxes for 2 years prior to your application. Your project must retain or create jobs.

Approval Amounts: up to $5 million

Terms: Repayment up to 10 years for equipment or machinery or 20 – 25 years for purchasing or converting land or buildings.

SBA Disaster Loans

SBA Disaster Loans are eligible to businesses of all sizes, private non-profit organizations, homeowners, and renters. These loans can be used to repair or replace real estate, personal property, machinery and equipment, inventory and business assets damaged or destroyed in a declared disaster.

Requirements: business must be located in an officially declared disaster area

Approval Amounts: businesses may qualify for up to $2 million

Terms: Repayment could be up to 30 years

APR: Won’t exceed 4% if unable to obtain credit elsewhere, 8% with credit available elsewhere (SBA determines if applicant has credit available elsewhere)

SBA Veterans Advantage

The SBA Veterans Advantage loan program is designed to assist veterans in acquiring capital to start, grow or succeed in business.

Requirements: To be eligible you need at least 51% controlling interest in the business by a qualifying person who is one or more of the following:

- Honorably discharged veterans

- Active Duty troops eligible for the military’s Transition Assistance Program

- Service-disabled veterans

- Reservists

- Active National Guard members

- Current spouse of any veteran, active duty service member, Reservist, or National Guard member

- The widowed spouse of a service member who died while in service

- The widowed spouse of a service member who died as a result of a service-connected disability.

Approval Amounts: up to $350k

Advantages and Disadvantages of SBA-guaranteed Loan

There are several advantages along with some disadvantages of an SBA-guaranteed loan. Below we’ve highlighted these advantages and disadvantages to help you determine if this type of loan is right for your business.

Advantages of SBA Loan

- Usually have longer repayment terms. Up to 10 years for the popular SBA 7(a) Loan.

- Lower interest rate compared to most other business loan options

- There are SBA Loan options for both new and existing businesses (the SBA loan option available through Small Business Funding is the 7(a) which requires 2 years in business)

Disadvantages of SBA Loan

- Loans require additional paperwork

- The approval process may take longer

- If approved, timing to receive funding may take longer (4 weeks or more with Small Business Funding)

Requirements for SBA Loan

Qualifying for an SBA Loan is going to be more difficult then most other funding options due to the more stringent requirements. While there are a number of different SBA Loan options, most of them share the same general requirements.

Time in Business

The SBA wants to see that you have good and sustainable record of operating a business. So for most lenders the minimum time in business tends to be 2 years.

Personal Credit Score

Your personal FICO score will need to be at least 650.

U.S. Location

Only businesses that are owned and operated in the United States will be eligible for an SBA Loan.

SBA Approved Industry

Ineligible businesses includes real estate investment firms, firms involved in lending activities, gambling activities, non-profits to name a few You can view the complete list of ineligible businesses on sba.gov.

Annual Revenue

You will need to be profitable with little to no negative balance days.

Steps for Getting an SBA Loan

The process of getting an SBA Loan takes longer than most other loans. In addition, it will require more paperwork.

1 – Check that your business will be eligible based on the requirements above

2- Choose an SBA program that’s right for you

3 – Decide on an SBA Partner lender. You can either apply through a traditional bank or complete an online funding request form.

4 – Gather your paperwork. While the amount of paperwork required will depend on the lender and the type of program, here are a few documents most lenders will want:

-

- Two complete years of business tax returns

- Two complete years of personal tax returns

- Current Profit & Loss Statement

- Current Balance Sheet

- Proof of ownership

- Business licenses and leases

5 – Complete a loan application

The Best Alternatives if You Can’t Get an SBA Loan

Since the lender requirements are more stringent for an SBA Loan, you may not qualify. But there are other funding options that you may qualify for.

Here is a summary of Small Business Funding’s other top business loan/funding options:

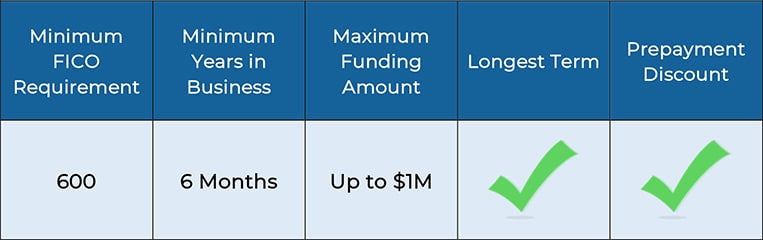

Working Capital Advance

Ideal if you have bad credit, need quick capital, and have been in business a short period of time.

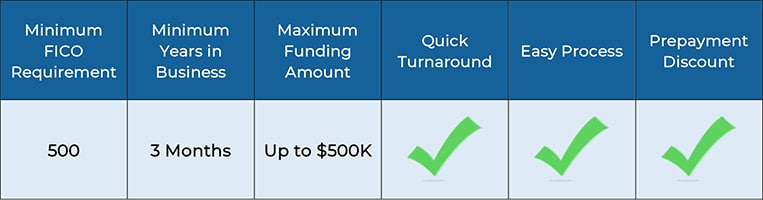

Business Line of Credit

Ideal if you need flexible, quick funding but do not have perfect credit.

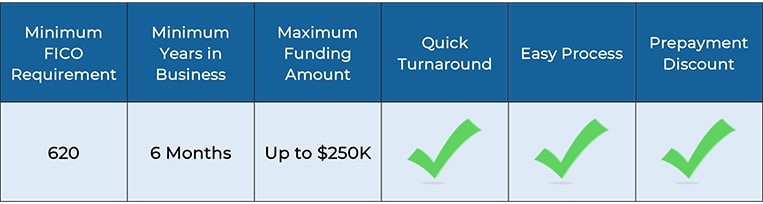

Short Term Business Loan

Ideal if you’re seeking a more traditional loan structure, need quick capital, but do not have perfect credit.

Equipment Financing

Ideal if you don’t have immediate cash or collateral on hand, need to purchase equipment quickly, and do not have perfect credit.