As the PPP program ended in August, a rather alarming trend could be seen in overall bank lending, particularly as it related to small businesses. Banks began tightening lending standards across the board according to a Federal Reserve survey. This is in spite of the fact that the demand has dropped somewhat for traditional loans and all the while the Fed is actively encouraging banks to loan. Because of this, small businesses are turning to alternative lenders to get the working capital they need.

Small business loan approval percentages at big banks – those lenders with at greater than $10 billion in assets – and small banks dropped in August 2020. The PPP loan program ended on August 8, and it has been tough to secure traditional small business funding in the coronavirus era,” said Biz2Credit CEO Rohit Arora, who oversees the monthly research. “Big banks hit a record low approval rate of 8.9% in April and were slowly rebounding, but the curve flattened last month.”

In August, big banks granted only 13.6% of the loan applications they received, compared to 13.8% in July. Similarly, small banks approved 18.5% of funding requests, a small dip from 18.6% the previous month.

“The discouraging part is that the trend over the past several months had been positive. Now it seems to have leveled off,” added Arora, one of the nation’s leading experts in small business lending. “It’s a wait-and-see attitude – especially when some businesses are not yet operating at full capacity.”

From commercial real estate to credit cards and autos, institutions are getting tougher on giving out money compared with the second quarter, even though demand also has decreased across most categories. The Fed’s senior loan officer survey also found that foreign banks also are showing a reluctance to lend.

The Fed survey’s findings reported that major shares of banks that reported reasons for tightening lending standards or terms cited a less favorable or more uncertain economic outlook, worsening of industry-specific problems, and reduced tolerance for risk as important reasons for doing so.

Given this difficult lending environment is coupled with the general uncertainty and partisan gamesmanship of a national election, and it would seem small businesses are left out in the cold fall air. Alternative lending offers hope where banks shut the door.

Small Business Owners Turn to Alternative Lending

The term “Alternative Lending” is not a negative term. Rather, it refers to business loans that are available to small business and consumers that fall outside of traditional bank lending. Instead of large banks or credit unions, these alternative lenders are usual;ly web-based, companies that operate in a similar fashion to a bank.

Typically, alternative lenders offer a range of products for small businesses including business lines of credit, invoice financing, equipment financing, traditional term loans and more. The big difference in their underwriting. Where bank loans are traditionally difficult to qualify for, forcing an extensive application processes, and lengthy-time to funding—alternative lending is characterized by speed, flexibility, and accessibility for those who cannot get capital in traditional ways.

Because Alternative lenders will allow for lower credit scores, they will take on more risk and with higher risk, comes higher rates and fees. An alternative lender will have more flexible requirements (credit score, time in business, annual revenue), thereby offering funding to a wider variety of small businesses.

If your small business is not meeting the more stringent lending criteria, then you should explore working with a company like Small Business Funding who can work with you to find alternative lending options.

Some of the most common products offered to small businesses

Working Capital Advances

Whether it’s for payroll, inventory, materials or expansion, Small Business Funding can help you secure the Working Capital your business needs to keep thriving. While a traditional bank loan may be more cost effective, in many cases the process can be long and tedious and decisions on approval or decline may take as long as a month or two.

Traditional loan underwriting places a lot of weight on personal credit and time in business, where alternative lending products such as a Working Capital Advance place less emphasis on these factors.

Line of Credit

A Line of Credit for your business provides a very flexible option for controlling when and how much funding you take on. Once approved, you can draw as little or as much as you want up to the maximum approved amount, which ensures that you never have to pay for more money than you need. And with no prepayment penalty you can pay back whenever is feasible, potentially reducing the interest you pay.

Term Loans

For those that want the benefits of a more traditional loan but still need the funds in as short a time as possible, we can offer a standard Term Loan. Term Loans are slightly easier to obtain than an SBA Loan, and time to funding is faster, but maximum repayment time will be shorter and they still carry relatively strict approval requirements as indicated below.

Typical uses are for working capital, to refinance debt and to purchase equipment.

SBA Loan

An SBA Working Capital Loan has been referred to as the “gold standard” of loan options for small business owners. It is a government-backed loan that is partially guaranteed by the Small Business Administration (SBA), an agency of the federal government.

While these loans are harder for small business owners to qualify for due to more stringent requirements as listed below, they are truly one of the best options for those businesses looking to refinance debt, hire employees, purchase equipment, or just looking to expand.

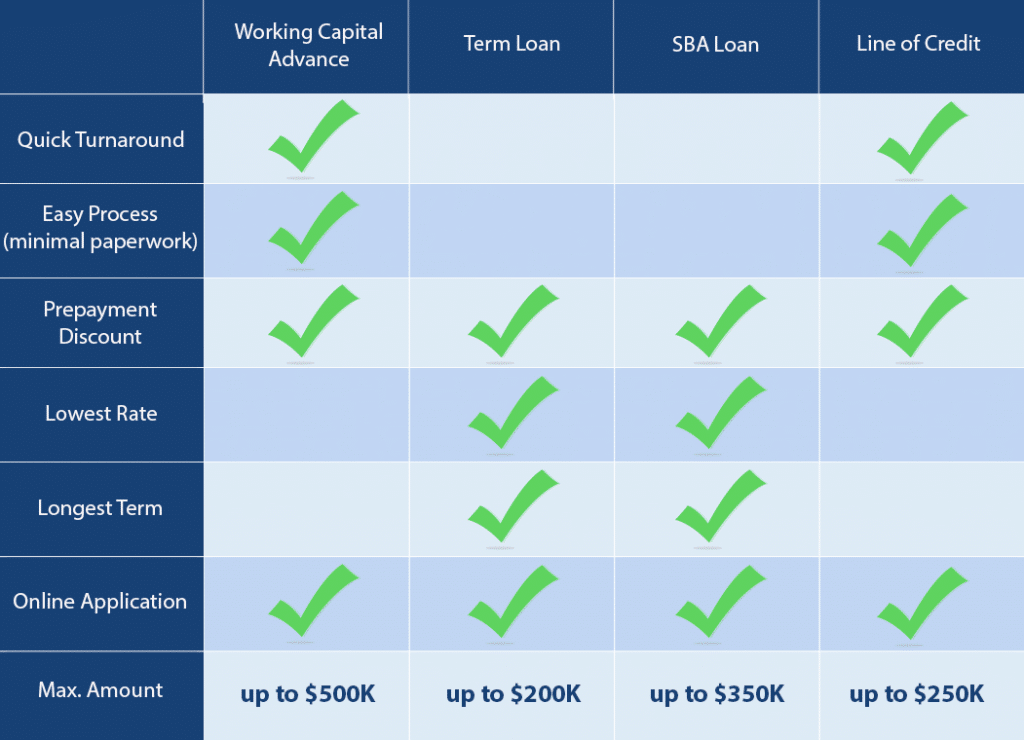

A comparison of plans is below:

About Small Business Funding

We are the one stop alternative financing funding source. Regardless if you have bad credit, short time in business, tax liens, judgments, or fast capital needs, we are your solution.

Our philosophy is why work harder when you can work smarter? That’s why Small Business Funding, through our network of financial partners, work with multiple providers on your behalf. Getting you the best rate and terms for your business.

Our network offers you access to quick and easy working capital to meet your individual business needs. We will put together a program to suit your business goals and financial situation, with ease. Why fill out 2, 4, even 6 applications when all you need to do is fill out one?

Small Business Owners

We recognize that small businesses are the driving force to grow our economy. In good times, as well as the challenging times, business owners need a fast cash flow solution. Whether you use it for payroll, purchase new equipment, expand inventory, pay taxes, etc.

Fact is, it doesn’t matter what you use the funds for, as long as it helps grow your business and increase your revenue!

If your company was turned down by traditional lending sources, such as banks and other commercial lending institutions, Small Business Funding can help.

Let us take all of the leg work out of the search and let you focus on what you do best.

We bring you choices and you decide which loan or funding option best suits your needs.

Small Business Funding exists to help you get the working capital you need to expand your business and keep you growing.

Join our family – we look forward to serving you. Apply today