How Much Working Capital Do You Need To Grow Your Business?

This is a question asked by many small business owners.

How do you decide how much you need to sustain and even grow your business? It’s easy every single week to say “your business is bringing in x and you’re obligated to spend y.” As a business owner, you just hope that “x” is always greater than “y.”

But understanding your working capital needs goes much deeper.

If you’re always calculating “x” and “y” for the current pay period, you’ll never actually get ahead. It would be difficult to know what you can invest, and what needs to be cut back, if you’re always looking at the short-term.

But before we get into how much you need, we first need to discuss what is working capital and how is it calculated.

What Is Working Capital?

Working capital, according to Investopedia, is “a measure of both a company’s efficiency and its short-term financial health.

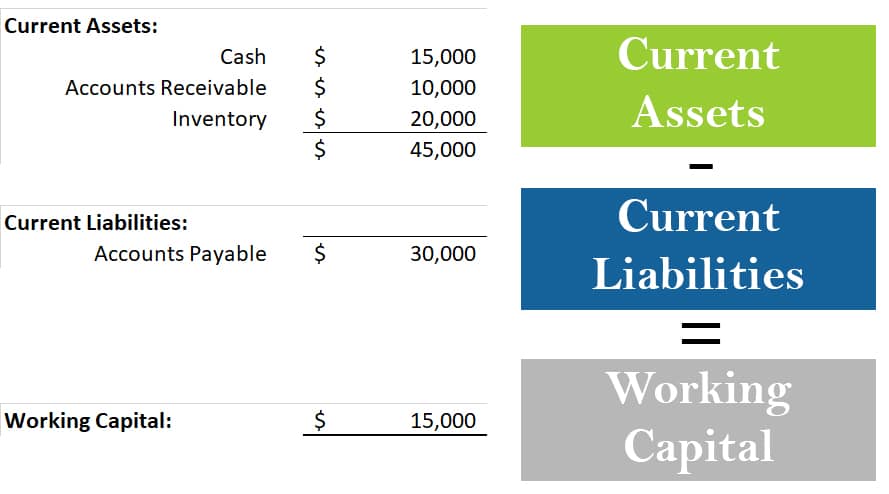

It is calculated as:

Working Capital = Current Assets – Current Liabilities

So for example, the cash used to fund growth in the short-term such as inventory and accounts receivable is considered working capital.

Why Is Working Capital So Important?

Working capital is critical to the success of your business. It’s needed to meet the ongoing operating needs of your organization. When you have capital on hand you are able to pay your short-term debt. If your income fails to exceed your expenses, you will no longer be able to pay your creditors in a timely manner.

This is especially difficult for seasonal businesses, who often take out an advance so they can pay their debt when their income fails to exceed their debt during their slower months.

How Much Working Capital Do You Need?

Each type of business requires a different amount of working capital. For instance, someone in retail would need a much more than someone in a service-based industry, such as consulting. This is because retail needs inventory and other operating expenses that a consultant may not need. In addition, business seasonality also plays a factor in the amount your business may need.

You will need to understand your operating cycle in order to determine how much working capital you’ll need. Your operating cycle looks at:

– Account Receivables – this is money due from the sale of a product or service which has not yet been paid

– Inventory – this is your products that you have net yet sold

– Accounts Payable – this is money owed by your business from your creditors. It’s also your payroll and other operating expenses.

– Timing – how many days within your operating cycle does it take to receive your accounts receivables, how quickly your inventory is moved, and when you receive your accounts payable.

– Growth – what is your projected growth

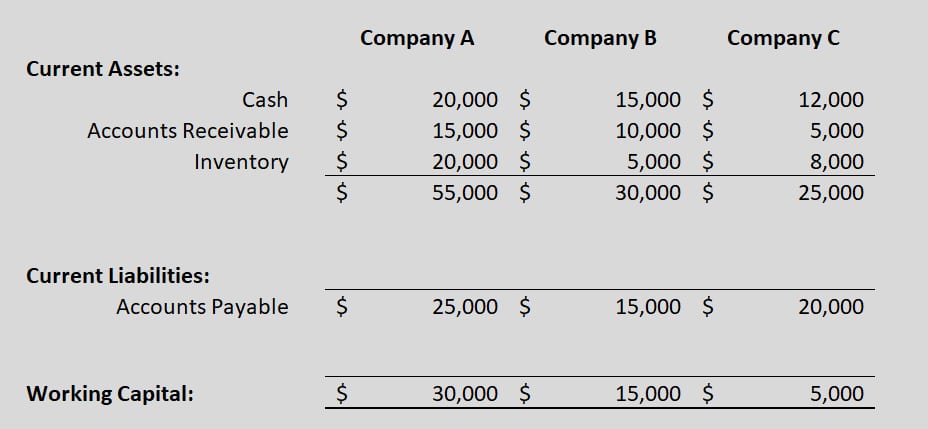

Let’s take the follow example:

Company A has $30,000 compared to Company B with $15,000 and Company C with $5,000. Company A can spend more money on marketing, advertising, inventory, expansion, equipment, etc, in order to grow their business faster than Company’s B and C.

Button line, the more working capital you have, the quicker you can grow. Company A may have enough to pay for new equipment, additional inventory, expansion opportunities, etc. Whereas Company B and C may need to take out an advance or loan.

So when determining how much you need, ask yourself:

– What is my projected growth and in what period of time?

– What is my current short-term working capital?

– How much investment does my business need to grow?

– Is my business in a position where it is ready to expand?

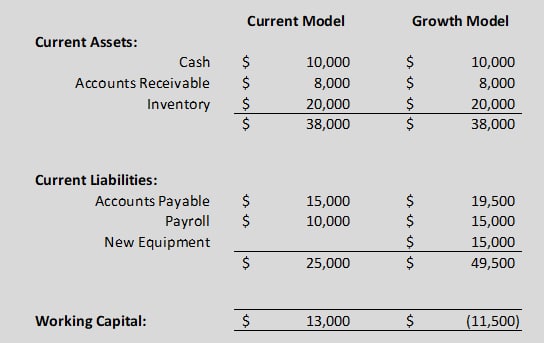

The below example compares a current working capital model vs a model where a company purchases new equipment and hires additional employees. In this example, payroll increased by $5,000 and a new equipment purchase was $15,000.

The short-term is negative ($11,500). In this situation more working capital is needed in the short-term to make those investments. The total amount needed depends how much you want to be in the black.

What To Do If You Need Additional Working Capital?

Additional working capital is often needed by businesses, especially as they look to grow. In these situations, businesses need to borrow money. This is where Small Business Funding can help. Once you’re pre-qualified, one of our Funding Manager’s will work directly with you to get you funded. You could be approved up to $500,000 and have that funding within three days.

So when thinking about how much working capital your business needs, it is important to look toward the future so your business can continue to thrive and grow. By only looking at the immediate future you are keeping your business is the same place. And no one wants their business to be stagnant.