Several economists are predicting that we may be in a recession soon. Exactly when this potential recession may hit is unknown but several indicators suggest it could hit next year.

The biggest indicator so far has been the inverted yield curve which first occurred August 14, 2019. An inverted yield curve is when the yields on 10-year US Treasury bonds dip below the yield on the 2-year US Treasury bonds. This is a direct indication that investors are worried about their long-term investments.

An inverted yield curve has proceeded every recession dating back to 1955. Based on this information a recession has accorded between 7 – 19 months later.

Historically during a recession, small businesses are impacted the hardest.

This is due to a lack of cash reserves, no large capital assets for collateral, and difficulty securing funding compared to large business. As such small businesses have a much more difficult time surviving a recession.

However those small business that are prepared have a much better chance of survival. As a small business owner you need to know:

- what to expect

- how to prepare

- how to manage your business during

Impact of Recession on Small Businesses

1 – Reduced Cash Flow

Insignificant cash flow is the number one reason companies go out of business. During a recession your cash reserves drastically shrink, and some of these factors may even be out of your control.

When cash flow if tight, companies will begin to delay payments to their vendors. This may include you. It’s a trickle-down effect – you provide goods or services to a client and you’ve set a net 30 payment terms. The cash flow for your client is tight so they pay you late. Now you pay your supplier late or you just don’t have the cash to pay for inventory or services critical to your business.

Also, during a recession consumer spending is down. That’s less revenue for your business, yet your expenses remain the same. This also has a significant impact on your cash flow.

2 – Decreased Demand

Companies are looking to cut cost in order to remain profitable. You will see a slow down in your business, no matter your industry. During a recession consumer spending slows down. This will result in business spending less due to lack of demand.

If you’re a B2B or B2C, a restaurant owner or a manufacturer of goods, expect demand to decrease.

3 – Budget Cuts

When your business slows down and you have less cash flow to pay for supplies, repairs, marketing, staffing, you will look to cut expenses.

This may be reducing your spend on marketing or laying off employees. Ultimately cuts need to be made somewhere in order to get you out of the red.

4 – Capital may be hard to get

In non-recession times, when you need capital to invest in your company, you look to get a loan or other funding from a traditional bank or alternative lender. During The Great Recession it was nearly impossible for small businesses to get a loan because banks deemed them to risky. Possible due to an over-leveraged house, low credit score, or lack of collateral.

A lot of alternative lenders where born out of The Great Recession. Knowing small business are the backbone of the economy, alternative lenders provided some of these businesses access to working capital.

5 – Suppliers Going Through Rough Time

You may experience a disruption in your supply chain due to challenges your suppliers may be experiencing. This disruption will affect your overall production leading to a slow down and loss of revenue.

How to Prepare For A Recession

Now that you understand the potential impact you may experience during a recession; how can you prepare for it?

1 – Identify Alternative Vendors

This is just doing your due diligence by identifying a potential alternative vendor. You don’t want the potential struggles your vendor may face to negatively affect your business.

Simple start the research, develop relationships and get pricing. That way the time-consuming work is out of the way should your vendor fall on hard times during a recession. And your operations won’t suffer as a result.

2 – Invest For Growth Now

If you have the opportunity to purchase new software, equipment, or technology to advance your business, do so now.

For starters, you will have an easier time getting financing before a recession. Plus you can start using the investment to build your customer base or create more loyalty with your existing customers.

Also, invest in marketing and start scaling your business now. Increased brand awareness and more revenue driven from your marketing efforts will help you survive a potential recession.

3 – Get a Handle On Your Finances

Hopefully you have a good grasp of your current business finances. But if not – do so now.

Managing your finances is critical to all businesses, especially one trying to survive a recession.

4 – Lock-in Financing Today

The most important thing you can do pre-recession is to secure funding for your business today.

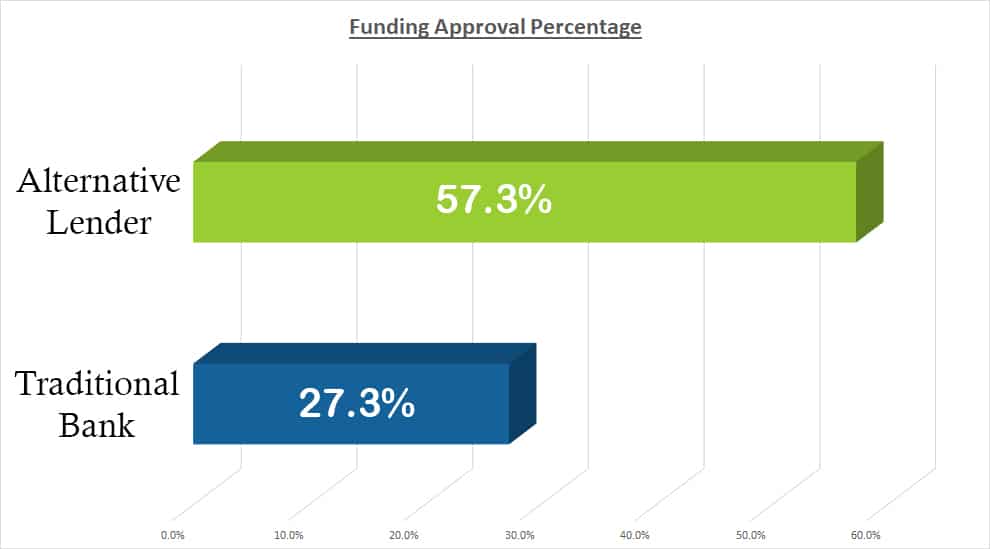

As I stated above, if a recession hits it will be more difficult to getting funding. Banks are going to be hesitant to give small businesses a loan. And alternative lenders, who typically approve 57.3% of small business applications compared to 27.3% for banks in non-recession times, may tighten up on who they fund. Although alternative lenders such as Small Business Funding will still be your best option.

If you have a low credit (FICO) score then you can looking into a Working Capital Advance and use that funding to improve your operations today.

Or if you have a high credit score (620 or better), you may be eligible for a Business Line of Credit. This funding option provides you flexible in that you only need to withdraw what you need and you only pay interest on the withdrawn amount.

The best time to get funding is when your revenue is up and consistent month over month. This steady stream of revenue is important for lenders to see when determining whether to approve you.

Name of the Game

During an economic downturn the name of the game is “survival”. You can’t rely or expect growth to get you through those difficult time. It will be a challenge but those businesses that do make it through will be stronger and in a better position to thrive in post-recession times.

But the key is how you prepare your business before the downturn that may ultimately determine your businesses fate.