We’re all in business to make money. Some of you even have the gumption to step out on that ledge and start your own company. Over 300 Million people will start their own business this year alone

Sadly, the reality is, only 1 out of every 10 startups will survive.

The 90% that don’t make it fail for a variety of reasons – lack of strong product, miscalculating the market needs, take on too much-too fast, pricing, poor marketing. The reasons are endless.

But one area you should not lose site of is your “Cash Flow”

According to CB Insights, who surveyed startup companies that went out of business, 29% of these businesses stated the reason their company failed was due to “Running Of Cash”. This was the second most given reason behind – “No Market Need”.

So how does something like this happen?

To explain I first need to define Profit and Cash Flow.

Profit vs Cash Flow

Profit – is a financial gain, the difference between the amount earned and the amount spent in buying, operating, or producing something.

Cash Flow – is simply the movement of money in and out of your business

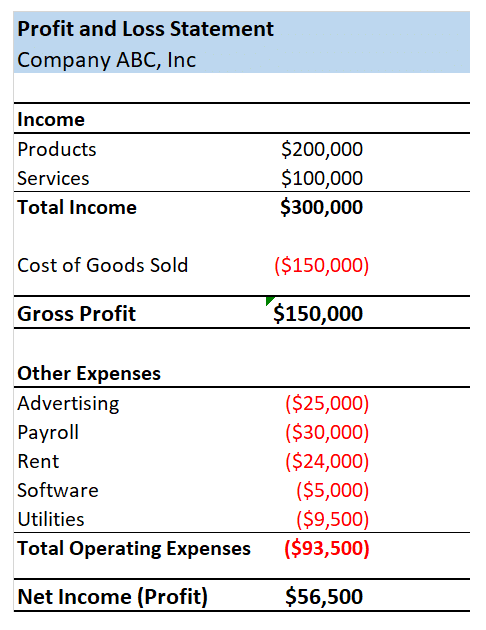

While every business operates to make a profit, here’s the catch-22. Let’s take the following monthly financial statement example:

A $56,500 profit, sounds great. After all, we’re all in business to make a profit.

Now let’s look at the cash flow side of this financial statement.

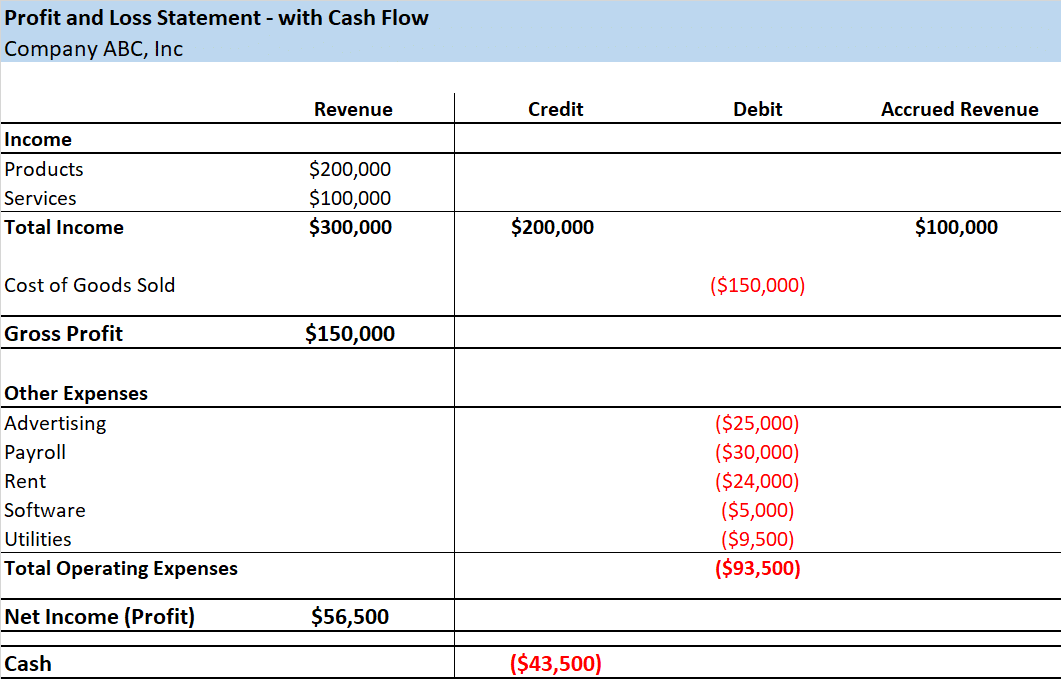

Let’s say of the $300,000 in revenue, your clients are paying you in monthly installments for 6 months.

Here’s what your financial statement looks like now:

So while you still have a profit of $56,000, you don’t have the cash on hand to pay your employees, purchase new equipment, expand inventory, etc.

You may have heard the statement:

“Cash Is King!!!”

In business, the meaning behind this statement is quite simple.

It puts you in a better position when it comes to buying power.

Growing a company can put a strain on cash flow, and that’s why 29% of businesses state going out of business due to lack of cash.

Options to Improve Cash Flow

You may not have enough cash on hand to cover your expenses at a given time. And that’s normal and to be expected for small businesses (and even larger businesses).

Here are a few options to help you maintain a healthy cash flow:

1 – Change your payment terms with your clients. Consider changing from a net 60 to net 30

2 – Offer small discounts to early payers. It doesn’t need to be much, depending on the amount your client owes, something as small as a 2% discount if paid within 7 days may do the trick.

3 – Use your business credit card when purchasing good. Just make sure you pay this off immediately so you don’t pay the interest rates.

4 – Put your cash to work – look into a high interest business savings account

5 – Look into a business line of credit, working capital advance or other type of funding option. This is where Small Business Funding can help. We are able to provide you access to quick working capital. In most cases you can receive funding within 72 hours.

Conclusion

Keep a close eye on your cash flow and forecast out in order to anticipate when your cash flow may be low. This is where a small business loan can help ensure a steady cash flow, especially during the startup and expansion of your business.