According to studies, small businesses (referring to a company with fewer than 500 employees and less than $7.5 million in annual revenue), account for 99% of all US businesses. These businesses are clearly the frame on which the economy is built, an indispensable force for employment, financial security, and personal independence.

Small businesses are also a pathway of upward mobility for many. Of the 30.2 million small businesses in the United States, 12.3 million are owned by women. Of those, 47% are owned by women of color. Across all small businesses, minorities own 45%. Because of these statistics, it is believed that small businesses are one of the best ways for marginalized populations to rise in economic status.

But starting a small business is hard. According to the U.S. Small Business Administration Office of Advocacy, 50% of small businesses fail within the first five years of incorporating. For many, starting a business becomes more than a full-time job; it becomes a lifestyle that takes over nearly all your time. It’s no longer a nine-to-five, punch-in-and-punch-out type of work situation. Small business owners are dedicated, hard workers who put in extreme amounts of effort to make their dreams become a reality.

So, knowing the benefits of starting a small business, and knowing the difficulties that face small business owners, can help you survive. That’s where quick small business loans come into the picture. While they may not be right for every small business, a quick business loan may just be the thing you need to make it past that five-year hurdle.

Fast and Flexible Small Business Loans

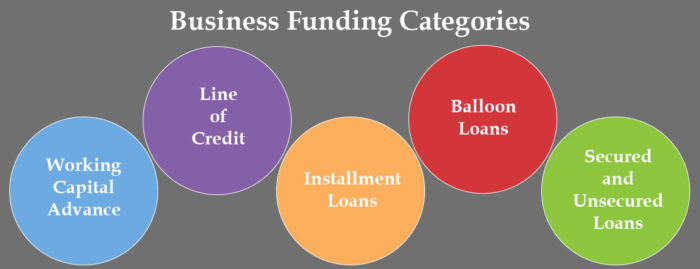

Just as there are many, many types of small businesses, there are many business loan solutions. Your company may have specific needs that differ from another organization. Here are five main categories of small business loans, and each one has options and variations.

Working Capital Advance

One of the easiest loans to apply for, and one of the fastest to get funded, is a working capital advance. This is a not a loan in the traditional sense, but an advance on your future revenues based on credit card receivables a business produces. Effectively, a small business gets a portion of the revenue that they would normally receive, and the lender keeps a portion as their payment.

Line of Credit Loans

Perhaps the most common type of loan for a small business loan is the line of credit loan. In fact, it’s so common that some consider it an essential form of loan arrangement since it protects the business from emergencies.

Line of credit loans are ideal for smaller, repeating purchases, such as buying inventory and paying operating costs. They are not intended for larger, one-time purchases, such as the purchase of equipment or real estate.

A line of credit loan is different from a credit card in that the lender is issuing a short-term loan into the small business’s bank account to be available (up to a certain credit limit). The business usually pays interest on the amount withdrawn. These loans are usually considered fairly low-risk by the lender—some lenders include a clause that they can cancel the loan if they believe the business is in trouble. Interest payments are made monthly, and the principal is paid off based on terms with the lender.

Installment Loans

These loans are a one-time lump sum, which is then paid back on a standard monthly basis which includes both interest and principal. An installment loan, in this sense, is very much like a car loan: it can be used to make a large purchase, and then paid off on a schedule in which, if the business pays extra toward the principal, they will end up owing less interest in the long run.

The terms of an installment loan are based on its time and use. A loan that is to be paid off in four months will have a lower interest rate than a loan that is to be paid off in a decade. The scheduled payments are usually monthly.

Balloon Loans

A lender won’t call this type of loan a “balloon loan” but you can recognize it by the terms: regular payments toward interest will be made on a set schedule, but a large “balloon” payment of the full principal will be due at the end of the loan period.

Balloon loans are usually saved for situations where a business is awaiting a large influx of expected cash and knows they will be able to make a large payment at the end of the loan period.

Secured and Unsecured Loans

Loans can come in two forms: secured or unsecured. When your bank is familiar with you and your business, and is confident in your ability to repay the loan on time, they may be willing to offer an unsecured loan.

An unsecured loan has no collateral offered to guarantee the lender something in the event the loan is defaulted. Newer small businesses are highly unlikely to qualify for unsecured loans with a traditional bank as they generally need a proven track record over a relatively long period of time. This is where alternative lenders, such as Small Business Funding may be able to assist.

A secured loan requires some form of collateral, but also typically has a lower interest rate than an unsecured loan.

The collateral offered up in the terms of a secured loan is usually real estate, equipment, or inventory. Since lenders use the collateral to pay off the amount of the defaulted loan, they’ll value it accordingly. A loan to be used to purchase a $20,000 piece of equipment will likely be financed at most with a $15,000 secured loan.

Letter of Credit

Typically used in international deals, this is likely a loan a small business won’t use. But it is a document that allows business owners to promise payment to suppliers in foreign countries. The letter substitutes as a line of credit.

Other Loan Types

There are many other types of loans that may go by different names, such as term loans, equipment financing, inventory loans, accounts receivable loans, guaranteed third party loans, and commercial loans.

Benefits of Each Quick Business Loan Type

Working Capital Advance

This is an attractive option as it is one of the fastest funding options as money can be transferred to your account in a matter of days.

Line of Credit Loans

The biggest benefit of a line of credit loan is in its flexibility.

You’re getting a credit line, not taking out a loan for a large sum. You may get approved for a large amount, but you can draw out as much as necessary (up to the approved loan amount). So, you’re only getting the money that you need when you need it.

Another benefit of the line of credit loan is that there is no penalty for early repayment. You can pay it back whenever it’s feasible, potentially reducing the interest you pay.

Installment Loans

Installment loans are convenient when you need to make a large purchase and want to pay it off on a regular, typically monthly, schedule.

Perhaps the best thing about an installment loan is how straight-forward it is.

Balloon Loans

Balloon loans often get a bad reputation because there’s always the dread of having to make that big looming balloon payment at the end. And it’s true that these loans can be poor decisions when you should, instead, be looking for an installment loan, a secured loan, or a line of credit.

That said, sometimes balloon loans are just the thing that you’re looking for. If your company is awaiting a large influx of cash from an upcoming closing business deal, a sale of property, or perhaps a lawsuit judgment, then making small interest payments in the short term while waiting for a large balloon payment when you have the cash, just may be the right thing for you.

Secured Loan

The benefits of a secured business loan are the interest rates are typically lower due to secured collateral which reduces the lender’s potential risk. They also may have longer repayment terms, a higher loan amount, and (for an established business) could be easier to obtain.

Unsecured Loan

Unsecured loans are a great option if your small business is in a good financial situation, with a strong track record and a quality credit score. If you can manage an unsecured loan, then you know that you’re not putting precious collateral on the line for the lender to seize. This is especially important if you’re using personal assets and property to get a secured loan.

You will pay a premium for a secured loan, in terms of a higher interest rate, but you’ve also got a little less skin in the game, which may be very appealing.

Letter of Credit

The main benefit with a letter of credit is the ability to safely expand your business internationally. You may need to jump through a few hoops to get this loan, but it may be just what you need.

Quick Business Loan Qualifications

There are certain requirements needed to qualify for a quick small business loan. Here are the 5 most commonly used among lenders. Keep in mind that each lender’s qualification’s may vary.

Use personal and business credit scores

Your personal credit score, which ranges from 300 to 850, represents your ability to pay back a loan. Your FICO score, commonly used in lending decisions, is based on five things:

- Payment history

- Amounts owed to other credit cards and debt

- How long you’ve had credit

- Types of credit

- Recent credit inquiries

Small business owners often use their personal credit score because their business doesn’t have a credit score yet or the lender wants to evaluate the owner’s ability to manage their finances.

Lenders’ individualized minimum requirements

Meeting a lender’s minimum qualifications makes you a much more attractive applicant. Some lenders have flexibility in requirements if you are low in one area but high in another, but your best chance of qualifying is by meeting all the minimums. The actual minimums for each may vary per lender.

Lenders are typically looking at a borrower’s:

- Credit score

- Annual revenue

- Years in business.

- Also, lenders don’t like to see recent bankruptcies and past delinquencies.

Loans that are backed by the U.S. Small Business Administration (SBA) have additional requirements. Your business must meet size requirements (because it is only for defined small businesses). Borrowers also must be current on all government loans with no past defaults—things like a federal student loan or a government-backed mortgage.

Your business also can’t be on the SBA’s list of ineligible businesses, which include things like life insurance companies, banks and real estate investors.

Qualifying with online lenders is typically easier. Keep in mind, the speed and ease of qualification may come with higher interest rates.

Gather financial and legal documents

Lenders may ask for any of the following:

- Personal and business income tax returns

- Balance sheet and income statement

- Personal and business bank statements

- A photo of your driver’s license

- Commercial leases

- Business licenses

- Articles of incorporation

- A resume that shows relevant management or business experience

- Financial projections if you have a limited operating history

Requiring all of these documents are more often required by banks than online lenders. Online small business lenders have more flexibility and speed in processing a loan.

Also, not all online loans have higher interest rates than banks—if you have good credit and strong business finances, interest rates may be comparable.

Develop a strong business plan

Business plans are usually required by a bank. They want to know how you’re using the money. And they want to see that you have the ability to repay the small business loan. A traditional bank may ask to see a business plan that outlines these things.

Online quick business loan lenders don’t tend to ask for these documents, as long as you can provide them with the basic information about credit, revenue and length in business.

Provide collateral

To qualify for a secured small business loan, you’ll need to provide some form of collateral, such as inventory, equipment, or real estate.

How Do I Get a Quick Business Loan?

There are two ways to get a business loan: with your bank, or with an online lender.

The process for securing a business loan with a bank typically takes longer. This is due to their business model not being designed for fast paced loan approval. An online lender, on the other hand, can get you the money that you need in a relatively short approval process. And with a quicker turnaround time, you get cash in your hands sooner.

Typically, with an online loan you will fill out a funding request form after which a lender will get back to you—often in minutes—to discuss the application and your specific needs. That call will result in a request for certain documents, such as a completed application and several months of bank statements. The lender will then dig deeper into your application and documents to see if you qualify. This is the stage where they verify your credit and financials.

After this, the loan decision is made. This can happen in as little as 24 hours for something like a working capital advance, up to 4 weeks for an SBA loan. For the fast-turnaround loans, like a working capital advance, you can be funded in as little as 2-3 days. An equipment financing loan may take a week, and an SBA loan could take up to a month or longer.

Start Your Free Application Now