Working capital is essential to an operating business, as it allows for the day-to-day expenditures and purchases needed to keep inventory on shelves, employees paid, and business flowing.

It’s very common for businesses of all sizes to take out working capital loans to manage these expenses, and therefore there is a need to get these loans on the very best terms and from the best lenders.

What is Working Capital?

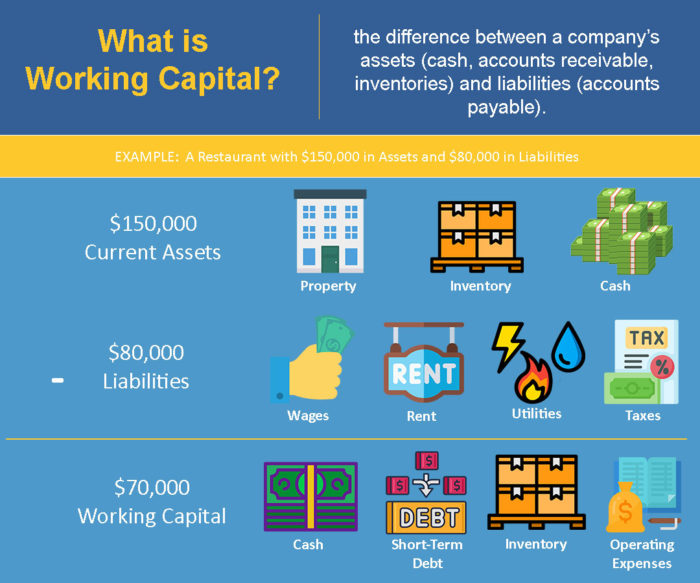

Working capital, also referred to as net working capital (NWC), is the difference between a company’s assets (cash, accounts receivable, inventories) and liabilities (accounts payable). Essentially, this means that working capital is the company’s liquidity–the ability to spend money when they need to.

It’s a measure of liquidity, operational efficiency, and short-term financial health. Having good access to substantial working capital means that a business can invest and grow, because it means you can put money into the short-term necessities.

The formula for finding working capital is to take the current assets (property, inventory, cash) and subtract the current liabilities (wages, rent, utilities, taxes) which will leave you with working capital, composed of cash, short-term debt, inventory, and operating expenses.

The Securities and Exchange Commission defines working capital as “Working capital is the money leftover if a company paid its current liabilities (that is, its debts due within one-year of the date of the balance sheet) from its current assets.”

What is a Working Capital Loan?

Given the information above, you might think that a healthy business should never need a working capital loan. After all, as long as you have more money coming into the business than leaving it, then you have a positive working capital, right? That’s not always the case.

While it’s important to have some cash in reserve, not being able to invest in prime opportunities may leave you at a disadvantage. You could miss out in valuable deals because of a lack of liquidity.

And what happens when an investment goes poorly and leaves you strapped for cash? Or what about when your work is seasonal and you are expecting a large influx of cash in the near future–but you need to invest in inventory now, before you have access to that money?

That’s where a working capital loan comes in. When money is tight, but opportunities present themselves, a working capital loan can help you make ends meet to reach those elusive investments. It also gives you a chance to catch up through sales and invoices.

A working capital loan is a type of business loan that can help when your business is in need of a quick injection of cash, for whatever reason. This isn’t used for long-term investments–there are other loans for that–but for short-term financial goals.

Working Capital Ratio

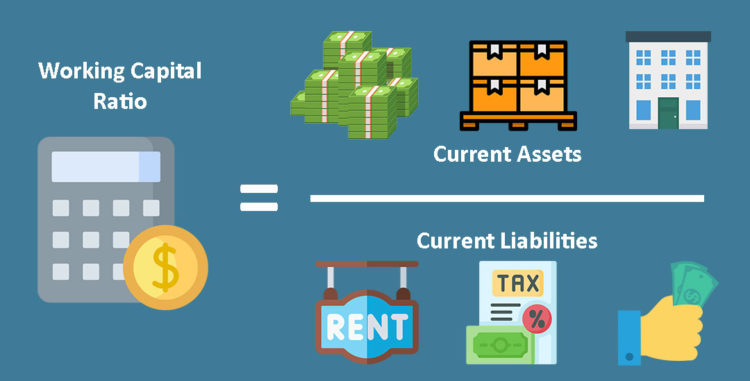

A good way to look at it is the Working Capital Ratio, the formula of which is:

Current assets / current liabilities = Working Capital Ratio

So if you have assets worth $100,000 and liabilities totaling $20,000, your working capital ratio is 5:1. It is generally accepted that you should have a working capital ratio of 2:1.

Working Capital Loans

Cash flow is one of the most stressful parts of running a small business. For every small business that fails in the first year, they say cash flow was the reason.

Working capital loans can be just the thing needed to keep a small business afloat and running through bumpy patches, seasonal unexpectancies, and emergency downturns.

These loans aren’t intended to be permanent fixes–they are a short-term solution to a short-term problem–but they are very effective at solving short term liquidity issues.

Types of Working Capital Loans

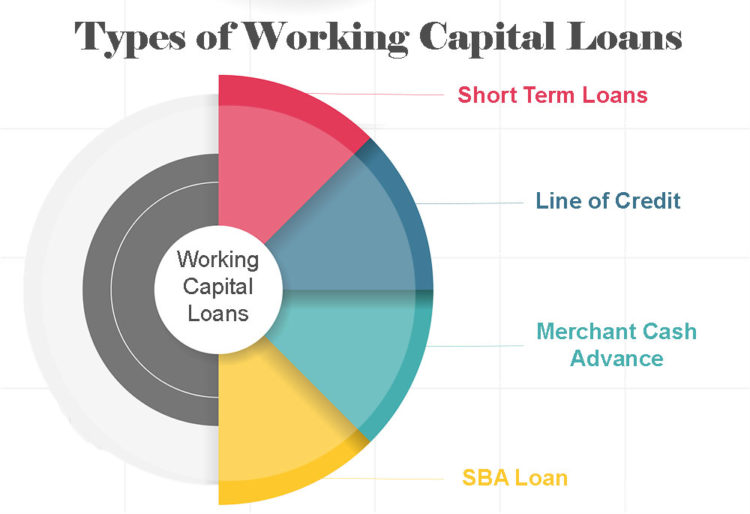

Working Capital Short Term Loans

These short-term loans, intended to cover a business’s daily expenses, will have shorter payback periods. Sometimes called Cash-Flow Loans, these usually have to be repaid to the lender within a year or less.

These are meant to pay for short-term expenses like inventory and wages, not longer-term concerns like equipment and real estate.

Working Capital Line of Credit

A line of credit loan is similar to a credit card, in that you have a credit limit set by the lender, and you can borrow against that limit as you need to. The difference is that, instead of being held on a credit card, the money is put into your checking account as cash. These types of loans are so common as to be considered standard for any small business.

Merchant Cash Advances

A merchant cash advance isn’t exactly a loan, but instead it is an agreement with a lender that they will give you a lump of money and will then extract a portion of any credit card payments your company receives. Rather than being paid monthly or annually, the lender takes the money daily from your credit card income.

The benefit to a merchant cash advance is that it is quick to be approved and to receive funding, but the downside is that the terms are very unfavorable and occasionally predatory. The APR on a merchant cash advance can be as much as 200%.

SBA Loans

Small Business Administration loans are generally considered among the best loans to get, as far as terms, but they are harder to qualify for and require more time to fund. An SBA loan is guaranteed by the SBA, so it is less risky for the lenders, which means the interest rates will be lower.

Qualifying is harder, however, particularly because you need a good credit score, both personally and for your business, and you need to meet certain criteria in regards to time in business and income. The process of approval and funding may take two to three months.

How Do I Get a Low Working Capital Interest Rate?

Getting a low interest rate on a working capital loan is absolutely possible, but you have to watch out for many traps and pitfalls. Some loans may entice you in because of their quick turnaround and approval and funding process, but they’ve got very poor terms. Other loans are much slower to fund but have much better terms. Picking the right balance is a decision that must be left up to you as the business owner, but it can make all the difference to your company.

If your concern is primarily with getting the best interest rate, you’ll want to stay far away from a Merchant Cash Advance. These loans are temporary stop-gaps at best, and can sink your business if you get in too deep–requiring you to take out loan after loan to pay the interest of the last loan, and getting sucked down into a spiral of debt. This isn’t to say they don’t have their place, but be wary.

The best interest rates for a working capital loan will come from an SBA loan, as these are guaranteed by the Small Business Administration, and the lender is taking less risk upon themselves. The terms can be very favorable. The downside to this loan is that the qualification process is much more difficult, rigorous, and time-consuming. You have to submit more documentation, including financial records such as profit-and-loss statements, balance sheets, and credit scores. And funding may not show up for months. If you’re in need of solving an emergency, an SBA loan might be unfeasible.

Perhaps the best middle-of-the-road loan is the line of credit, as it is a standard, non-predatory loan that is very commonplace in the industry and trusted. As long as it’s not abused (we all know the danger of overspending on a line of credit) it can have good terms and be used to deal with both present and future financial problems.

A final loan that may promise a low interest rate is the Invoice Financing loan, in which you present to your lender your accounts receivable and show the invoices that are going to be paid to you, and they loan you the amount of money you are expected to receive–with the payments going straight to the lender when they’re paid. These have low interest rates, but can only be used in specific circumstances.

Small Business Funding — Working Capital Advances

Small Business Funding offers a selection of working capital funding options, including the Working Capital Advance. It can be approved in 24 hours, and funded in two to three days. The requirements aren’t as stringent as an SBA loan, as you only need to have been in business for six months and have a minimum of $180,000 in annual revenue. You can be approved for up to $500,000, and the terms will depend on the amount you borrow, and the percentage of your revenue.