Rural areas are still facing challenges from the Great Recession — a sharp downturn in economic productivity that occurred between 2007 to 2009.

While all of America was affected by the recession, rural areas especially struggle to move at the same pace as urban areas. And as a result, these rural communities across the country are still struggling to recover their local markets and grow their small businesses.

Many small businesses need additional funding to boost profitability. Whether that’s to obtain new equipment, personnel, real estate or seasonal inventory. Rural businesses face even more challenges in the entrepreneurial sphere of the market at large. This is why you can find rural development programs meant to benefit both new businesses and the community they serve.

In order to stimulate rural communities with new, stronger market development, their local businesses need to have the assets and manpower to grow. That’s why rural small business grants have become so important. They can provide those additional assets needed for communities to become more entrepreneur-friendly. The extra cash in turn encourages small business growth that creates more job opportunities and infuses the local community with a livelier market that can be competitive with urban businesses.

The question is, what qualifies a small rural business owner for a grant?

How does the government define rural communities to begin with?

The answer to these questions should be straightforward, but there’s a lot of ground to cover. With a variety of grants, loans and services available to rural communities, one of the best places to start is the currently available grants for rural development and where they come from.

As we walk you through everything important to know about rural small business grants, we’ll also give you more details about whether or not you qualify for one and how to go about getting the funding you need.

Should you not receive or qualify for a rural small business grant, we’d still like to help with the growth of your small business. You can feel free to apply for funding with us today!

Rural Development Grants at a Glance

The U.S. Department of Agriculture has a variety of programs and services expressly made to help develop rural communities. The type of funding here ranges widely, from helping prospective tenants find housing to funding water and waste disposal.

In terms of business, programs like the Business & Industry (B&I) Loan Guarantee can help small businesses in a variety of ways, such as:

- Funding the expansion, modernization, repair or conversion of a business.

- Purchasing and developing land, easements and other buildings or facilities to grow a business.

- Purchasing equipment, rentals, machinery, supplies or inventory.

- Debt refinancing when it improves cash flow and allows a business to offer more jobs.

- Acquisitions of businesses and industrial providers for the purpose of creating or saving jobs.

While there are a number of restrictions for these programs (which we’ll get into later), rural small business loans can offer those guaranteed loans you need to infuse your business with more profitability while providing more jobs to the local community.

The B&I loan program we mentioned above has flexible maximum loan terms (7 – 30 years, depending on the loan’s purpose) and only a one-time guarantee fee in addition to an annual renewal fee.

When you’re looking for grants specifically, you have the options of working with government grants or private ones: both have their benefits and drawbacks. Government grants like those for rural business development include funding, technical assistance and training for applicable businesses. Public entities like towns, communities, state agencies, authorities and more are all potential applicants.

You can also find other federal organizations that encourage small businesses to engage in research for grants, like the SBIR program. In the case of SBIR, the goal is to stimulate economic growth through technological innovation while providing entrepreneurship opportunities for social and economically disadvantaged minorities.

Rural Small Business Grant Requirements

It makes sense that the first requirement for prospective grant awardees would be having a business in a rural area.

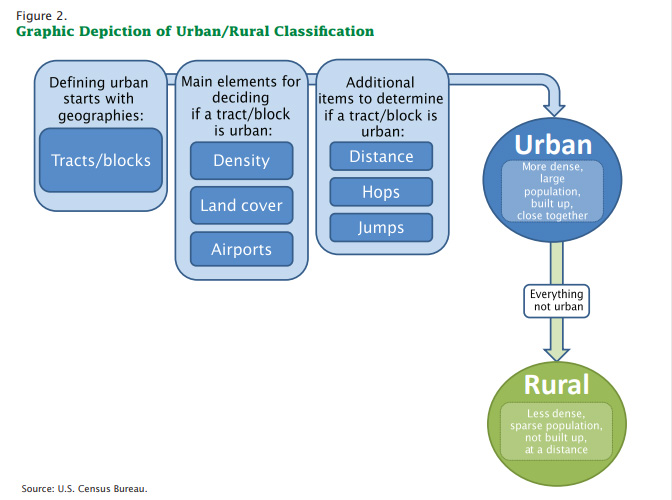

But what defines ‘rural?’

Even within the federal government, there’s more than a few different definitions for it. Generally speaking, however, a rural area is considered to be a place with less than 50,000 inhabitants that isn’t adjacent to an urban area.

Other grants (like those used for improving telecommunications or waste disposal) may define rural areas as smaller locales, but most rural small business programs fall under that first definition.

Who Qualifies for Rural Development Programs?

The qualifications vary from grant to grant, especially among private organizations. The federal government classifies potential applicants as “Rural public entities,” which includes everything from nonprofit corporations to the towns and communities themselves.

Guaranteed loans may offer even more flexibility, as the government will help fund everything from manufacturers and retailers to individuals and public bodies. Any size of business may be found eligible, but there are obvious restrictions for certain industries.

Generally speaking, the smaller your grant or loan amount is, the higher priority it is to be funded.

What are You Allowed to do with a Rural Business Development Grant?

Government grants are given with the specific intent to enrich the rural area surrounding the business, so any business investment that accomplishes this is a valid use of the funds. This can include training and technical assistance (business counseling, market research, project planning, etc.), the acquisition of land, pollution control, adult learning for job training, improving rural transportation and a wide variety of other expenditures that benefit the rural community at large.

Guaranteed loans have similar approved uses, such as purchasing equipment, developing business acquisitions, and covering startup costs.

What do You Need to Apply for a Grant?

Getting a grant isn’t quite as straightforward as filling out an online application. In order to apply, you need to be pre-registered with the System for Award Management and have a Data Universal Number System number. While it doesn’t cost money to make these registrations, it can take a significant amount of time for your information to be processed before you can apply for a grant. This is especially relevant across the states, where grant deadlines vary according to where you happen to be applying from.

Before you send in your application, you’ll also need to have important information ready to go. This includes:

- Evidence of the job creation which would happen if your business expanded,

- The percent of non-federal funding you have committed to your project,

- The economic need of your business’s area (and how well your business plans aligns with those needs) and

- Evidence of your experience working with similar small business building efforts.

How do You Apply for a Rural Development Grant?

The best place to start with your application is with your state office, which can furnish you with program specific information your state offers.

As we’ve mentioned before, you’ll also need to pre-register with the System for Award Management before you can apply for a government grant. That means creating an account with the System for Award Management, completing an online application, and searching through public records to find existing entity registrations or exclusion records.

You’ll also need a Data Universal Number System number. The Data Universal Number System, or D-U-N-S, is a number assigned to every business that interacts with the federal government. Once you register, your D-U-N-S number will serve to validate, identify and link your business within the federal system, which in turn helps you and the government track the progress of a grant you’ve applied for.

Applying for the System for Award Management and your D-U-N-S can take time, so it’s important to get this done well before applying to a grant. Deadlines can pass quickly and aren’t the same across the U.S., so the sooner you prepare, the easier it will be to apply for a grant or guaranteed loan from your state office.

What other Funding Options are There?

The typical problems small businesses run into can be exactly the same in rural areas. Most banks and lenders have relatively stringent requirements, which often include a certain amount of value in a business’s assets, their ability to prove consistent income and a good credit score.

It’s often easier for small businesses to get their funding from lending companies or grants (which can be found from more than just the government). Even companies like Wells Fargo and Walmart offer grants made to help small businesses grow, so you can find funding from private companies as well as the government when you need money for a rural business.

Develop Your Business with Small Business Funding

Small business loans/funding are our specialty. If you don’t have the time to wait for the government to process a grant or you don’t get a grant approval, you can look at the various funding options we have available.

Helping rural communities develop because of the business you bring is just one of the many benefits of the work we do.

Try applying today to see what we can do for you.