This country was built on the backs of small businesses. It’s estimated today that there are 30.2 million small businesses in the United States, and that they make up 99.9% of all businesses. (Small businesses are defined as having fewer than 500 employees.)

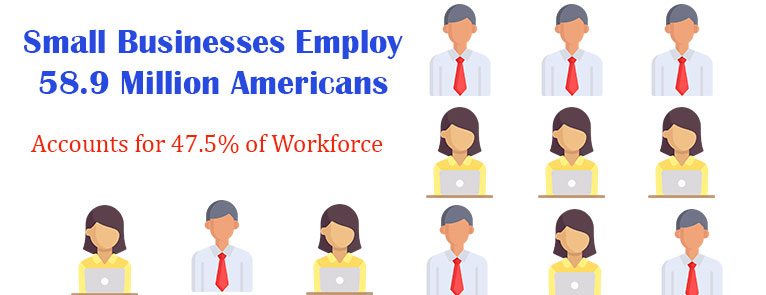

These include everything from restaurants to law firms to mechanic shops to general contractors. These companies employ 58.9 million Americans, which is 47.5% of the workforce. And new businesses account for nearly 100% of all net job creation. (New small businesses account for most of that–after five years it starts to plateau.)

The one thing that all of these companies have in common is that they need money to start their business. Whether it’s buying a delivery truck or leasing an office space or hiring employees, all of these startup costs are daunting, even to the most enterprising entrepreneurs–the kind who start a business in their garage and eventually have to move into something bigger.

So how do you make the leap? How does the tech company get out of their garage and into an office park? How does the caterer get a professional kitchen? How does the mechanic and the contractor buy new equipment?

The answer is with Small Business Loans or Funding. As you can imagine, since so many new small businesses crop up every year, there are plenty of places you can look to get a loan. The question is where you find the best loan and who is the best lender for you.

The answer depends on what you’re trying to do, how your financials look, and all the numerous things that determine:

“Do I qualify for a small business loan?”

Six Main Qualifiers for Small Business Loans

There are six main things that lenders look at when they’re trying to determine whether or not you will get a funding, whether you’re high risk or low-risk. Those six things are:

Credit

When a small business owner goes to a lender to ask for money, one of the first things that the lender will want to look at is either the owner’s personal credit score (if the business is brand new) or the company’s credit rating (if it’s been in business for a few years). While there is no hard and fast number that will qualify you for a small business loan, a personal FICO score of at least 650 is considered the norm.

Remember the most important things that affect your FICO score:

1 – Payment history (do you pay your bills on time, and how long have you been paying them on time),

2 – Credit utilization (of the amount of credit you’re eligible for, what percentage are you using),

3 – Length of credit history (are you brand new to the credit game, or do you have an established track record),

4 – New credit (have you recently applied for and received or been denied credit),

5 – Credit mix (what sorts of credit do you have–credit cards? Mortgage? Auto loan?).

By building your credit in those five areas, you put yourself in a much better position to be eligible for a new loan.

Cash Flow and Income

Many lenders will want to look at your financial statements, particularly your Profit and Loss documents and your Balance Sheets. They want to know how much money you’re bringing in and how much of it is profit. The better situated your company is, the less of a risk you’ll appear to your lender, and the more likely they’ll be to approve you for a bigger and better loan.

Remember, it’s not just about the amount of money a lender is willing to give you: it’s also about the terms they’re willing to offer. A high-dollar loan with a high interest rate may not be as beneficial as a low-dollar loan with a low interest rate. Be sure to compare rates and terms and don’t just jump at the money offered.

Age of Business

This concept is similar to both credit and cash flow, in that a lender wants to see whether you’ve got the chops for the long haul. They want to see that you have a track record of making money over a year or two (or more) and that you are not just a flash in the pan with a good idea and no business sense.

The longer you’ve been in business, the less of a risk you’ll appear to be, and the more likely the lender will be to loan you the money that you need.

Current Amount of Debt

While this is part of your credit score, a lender will also look at the amount of debt you’re already in to determine whether you can shoulder additional loan payments. If you’re already paying a mortgage on a building, a couple of auto loans for work trucks, an equipment loan for heavy equipment, the lender may not be so keen to offer you much more money unless you can prove you can make the payments on time.

Remember: the lender is gambling on you and they’re betting that you’ll do well–they want you to succeed–but they won’t bet on you if you’re too much of a risk.

Collateral

Some loans will want you to put up collateral for your loan. This is called a secured loan, because it’s made secure by the fact that the lender has a guarantee they’ll get something back.

The collateral may be a car, a piece of equipment, inventory, or even your personal home. This is a common practice and not something to be scared of–but it is important to be aware that if you can’t afford to pay your loan you might not only be out of a job, you’ll be out of a house, too.

Industry

During the loan process, the lender will consider your industry to weigh whether or not you’re likely to succeed. For example, a successful CPA looking to expand her office would be considered less of a risk than a brand new restaurant in a city that is over-saturated with restaurants. If the housing market is bad, a general contractor might have a harder time getting a loan. And so on.

So to qualify for a loan, you need to be aware of all of these factors and make sure that you’re doing your best to be a well-qualified candidate for that loan. We have professional waiting to help you walk through the process.

Start Your Free Application Now